We’re almost a month past 2024. A couple of months ahead of the last day of the holiday marketing season. It’s that time of year where we analyze what walked, what ran, and what needs a new plan. As we step into that zone, let’s sift through the data from the holiday season 2023 and compile a Holiday eCommerce Report for this year, guiding the marketing strategy for 2024.

Holiday eCommerce Report & Statistics 2023

Despite the initial trends presenting a lukewarm growth in the holiday marketing season of 2023, the actual numbers surprised the marketers. According to a report by Signifyd, the online sales in the United States rose by 7% from the 2022 holiday season. The upward trend was driven by an 11% YoY increase in online sales in December, which surpassed the early prediction of 3% YoY growth in online sales.

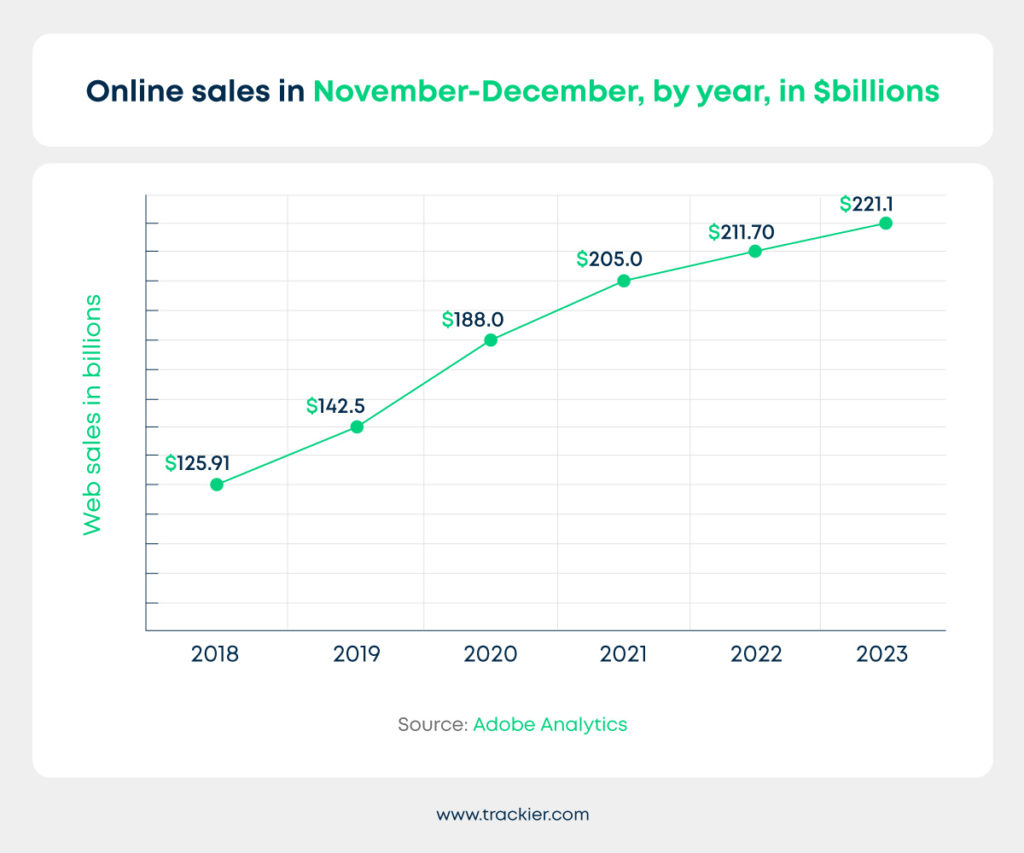

According to the latest Adobe Analytics figures, consumers spent $222.1 billion from November to December alone, which is in itself a record for holiday eCommerce with 4.9% YoY growth.

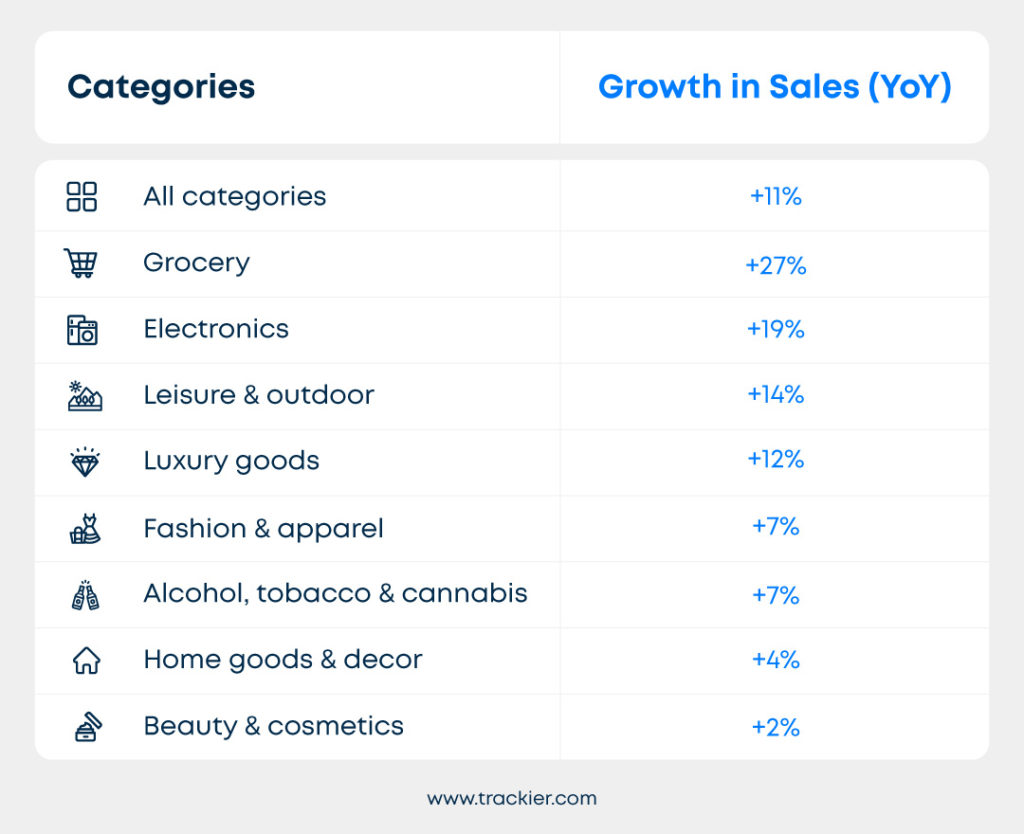

Holiday eCommerce Sales Statistics Category-Wise

The holiday season sales were led by grocery sales which saw a 27% YoY increase followed by electronics spending with 19% YoY increase. In the US alone, the holiday retail sales rose by 3.1% YoY during the period of November 1 to December 24, not counting Christmas and New Year’s Sale data, according to the payment processor Mastercard.

According to the report by Signifyd, consumer’s buying decisions were influenced by discounts during the holiday season. Hence, the discount code usage was up by 14% as compared to 2023, so much so that around 23% of online sales were accompanied by a discount.

During the Q4 2023, online discounts usage increased 20% YoY with 24% of all sales accompanied by discount.

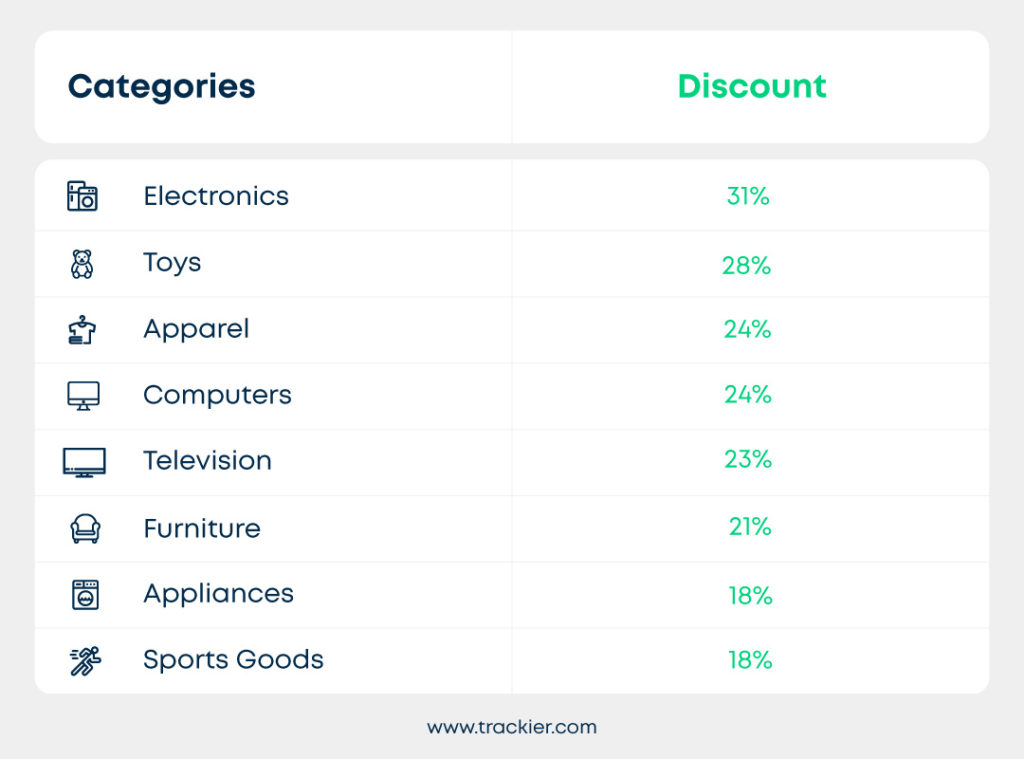

Holiday eCommerce Discounts Statistics 2023 Category-Wise

As we mentioned above, the decisive element for consumer purchases during the holiday season 2023 were discounts. This season, the shopping decision was less driven by impulse and more by reasonable cost and discounts.

Hence, discount emerges as the ultimate holiday shopping winner for the Holiday eCommerce 2023 edition.

Let’s have a look at categories leading the discount section.

Discounts peaked at 31% off listed price in the electronics category, 28% in toys, 24% in apparel, 24% in computers, 23% in televisions, 18% in appliances, 18% in sports goods, and 21% in furniture, according to Adobe Analytics.

Holiday eCommerce Trends 2023

Despite the dismal prediction in the backdrop of economic conditions, Black Friday and the entire month of November was a surprise for the eCommerce industry. The Cyber Week starting from Cyber Monday to Thanksgiving saw the biggest spike in eCommerce sales since February, as per the latest data by GlobalData.

The National Retail Federation also confirmed that the Thanksgiving weekend saw the highest customer traffic driven by early holiday sales, with 55% consumers leveraging early holiday sales with the majority of the shoppers planning their holiday shopping in December. (Shopify-Gallup).

Aside from early holiday sales, the option to Buy Now Pay Later (BNPL) also drove the shopping trend forward with a contribution of $16.6 billion in the online sales category. The BNPL feature was used 14% more than in 2022. (Adobe Analytics)

From Product Visualization to Commercial TV Series, How Brands Led Holiday Sales in 2023

Brands like J. Crew and Kohl set up holiday-themed stores and holiday events to attract the holiday frolickers into their sales funnel. In fact, just before the holiday season kicked off, social media giant TikTok launched its TikTok Shop in the US, identifying the social commerce trend in the country. With these efforts, consumers were exposed to marketing initiatives that seamlessly blended the festive spirit and drew them closer to the purchase. (Retail Dive)

The most innovative holiday marketing initiative was by Walmart when it announced a 23-part shoppable romcom series for TikTok, Roku, YouTube and social media channels. It was an incredible way to engage users through entertaining content that influences their shopping behavior.

Another innovative way by eCommerce giants to draw holiday shoppers was starting their sales early. Amazon led the trend by offering pre-Black Friday discounts a few weeks after its second Prime Day sale in October.

Following the lead, Walmart also opened its holiday sales Holiday Kickoff Deals followed by Target and Macy’s running sales weeks leading up to the Thanksgiving holiday.

Mobile or Desktop or Retail Stores: What Did Holiday Shoppers Prefer in 2023?

As per the data from retail analysts and experts, most people in 2023 preferred to shop on their phone versus desktop and in-person stores. Data from Adobe Analytics report suggests that mobile shopping took over the trends this year, putting desktop and retail shops behind.

Online sales peaked throughout the Cyber Week, with smartphones accounting for nearly 52% of sales. This data represents a shifting trend of consumers finding comfort in shopping through their mobile and brands focussing on building more user-friendly mobile experiences for their customers.

Social Media or Paid Ads: Major Sales Drivers of 2023 Holiday eCommerce

This holiday season, marketers diversified their channels to social media, affiliate marketers, email, etc. Despite this, the biggest driver of sales remains paid search with 29.4% of online sales, followed by direct website visits with 19.3%, affiliates & partners (16.6%), organic search (15.9%) and email (15.3%).

Despite the hype, social media’s contribution remained less than 5% of total online sales this holiday season. However, there has been a 5% YoY increase as per Adobe Analytics data.

Holiday eCommerce Data 2013-2023

According to the latest report by National Retail Federation (NRF), holiday sales have been growing at the rate of 5.1% every year from 2012 to 2023, in the US region. In 2012, consumers spent around $567.6 billion during the holiday season. Ever since then, the holiday shopping expenditure has seen dramatic growth.

During this period, 2021 emerged as a winner in annual growth with 12.7% YoY increase and holiday retail sales hitting as close as $881.6 billion. The year shattered 2020’s record when the holiday sales grew by 9.1%, kickstarting a promising era for eCommerce business, especially after Covid-19 lockdown effects eased down.

According to the NRF analysts, the slowest year in terms of holiday sales growth was 2018 when this number only rose by 1.8%.

Key Takeaways

- Despite the recessionary backdrop, 2023 emerged as a surprise year for the holiday eCommerce industry.

- Customers still preferred to spend on holiday sales but their purchase decisions were driven mostly by discounts and offers.

- Reflecting a shift towards smartphones, consumers opted for shopping on their phones over desktops or tablets.

- Among all categories, holiday shoppers leveraged online sales to shop for electronics and groceries.

- Buy Now Pay Later was one of the biggest drivers behind consumer spending during the holiday sales.

- Shoppers preferred to shop from within the comfort of their homes instead of walking into a retail store.

- To pull more customers in the sales funnel, major brands including Walmart and Netflix invested in creative holiday marketing strategies that included social media shops, shoppable ads, holiday-themed eCommerce store, and early commencement of holiday sales.

- Paid search ads and direct website visits lead the top spots as the major driver of sales in Holiday Sales 2023.