It is often more beneficial to keep existing customers than to continuously seek out new ones. This is where Lifetime Value (LTV) comes into play. Lifetime value is an estimate of the future value a customer will generate for your business, not just a metric. Businesses shift their attention away from short-term sales strategies to long-term relationship creation by understanding lifetime value.

Long-term success depends on tracking and optimizing customer lifetime value, whether you operate a subscription-based SaaS platform or an e-commerce company. Businesses can make marketing decisions based on data through the use of performance marketing software to accurately evaluate customer behavior across touchpoints.

What Is Lifetime Value (LTV)?

The total revenue a company can realistically expect from a single customer for the business relationship is known as lifetime value (LTV). It indicates the value of a client to your company over time.

Businesses can measure the long-term value of customer relationships rather than just one-time sales by knowing what lifetime value is. For example, if a consumer consistently buys from your brand for two years, the lifetime value of that customer would be the sum of all of their purchases.

For leaders, sales teams, and marketers, this marketing metric is equally necessary. Companies can identify high-value customer segments, estimate revenue, and decide how much to spend on customer acquisition.

Why Lifetime Value Matters

Knowing how much a customer is likely to contribute over time helps brands make better use of their resources and create sustainable, long-term growth. Here’s why it matters:

Improved Budget Allocation

You can adjust your customer acquisition cost (CAC) if you know a customer’s lifetime value (LTV). For instance, it might be acceptable to spend $100 to acquire a customer if the average LTV is $1,000.

Better Retention Strategy

Your retention strategies are likely to be successful if your client lifetime value is high. Understanding the factors that influence this value will help you focus your efforts on retaining customers for longer.

Informed Product Development

Improved products, features, or services can be influenced by your understanding of the relative value of various customer segments.

Targeting High-Value Clients

If the marketing teams have access to precise LTV data, they can focus campaigns and resources on clients who are more likely to produce larger long-term returns.

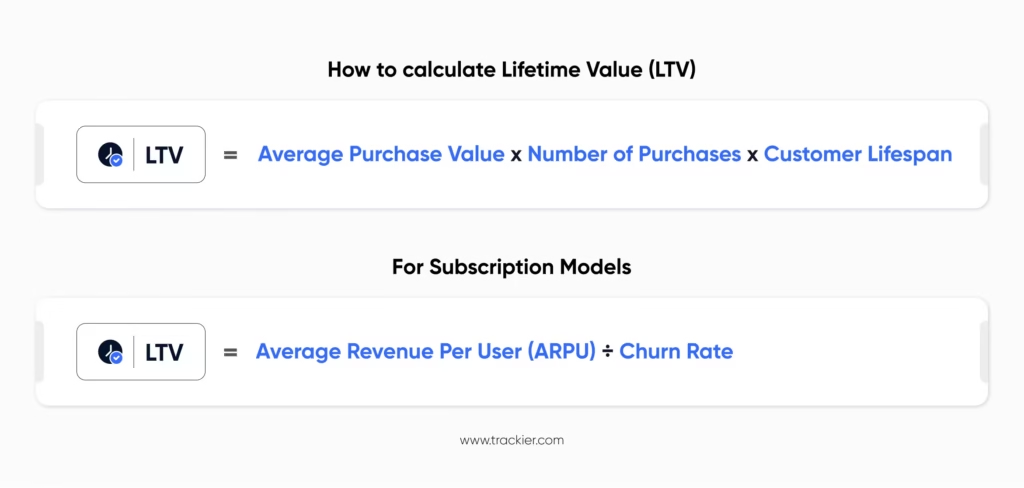

How to Calculate Lifetime Value

Depending on your business model, the lifetime value formula may differ slightly, but the following is the most common way to calculate it:

Let’s look at a quick example:

- Average Purchase Value: $10

- Purchase Frequency: 12 times a year

- Customer Lifespan: 5 years

LTV = $10 × 12 × 5 = $600

This indicates that $600 is the average customer lifetime value. You can use this number to estimate how much you’re willing to spend on customer service, loyalty programs, or marketing for that market.

Use Case

Suppose you own a shop selling handmade soap. According to your data, a customer usually spends $20 on each order, makes 4 purchases annually, and remains loyal to your brand for 3 years.

Using the formula for lifetime value (LTV), it is $20 × 4 × 3 = $240.

Now, if you’re spending $100 on advertisements to get each customer, the return is positive. However, you may need to change your approach or increase retention if your acquisition cost is more than $240.

This use case shows how knowing lifetime value helps in more accurate ROI calculations and better budgeting.

Types of Lifetime Value

Depending on your objectives and the available data, lifetime value can be viewed in several ways:

- Historical LTV – This is based on customers’ past behavior, such as average purchase value over the last year or total revenue from the buyers. Although it is accurate, it often overlooks the potential changes.

- Predictive LTV – Estimates future customer behavior using predictive analytics and machine learning. For example, it could predict how much a new user is likely to spend by looking at browsing history, engagement patterns, and previous purchases. Perfect for flexible strategies and rapidly expanding businesses.

- Segmented LTV – Evaluates how their client lifetime value compares by looking at particular customer groups (for example, by geography, product category, or channel).

Knowing what kind of LTV you’re using can help you in better targeting and more precise forecasting.

Factors That Influence LTV

Your lifetime value can be greatly impacted by several internal and external factors:

- Customer Satisfaction – Satisfied customers make more purchases and stay longer.

- Pricing Strategy – LTV can be raised or lowered by premium pricing or discount-heavy strategies.

- Customer Support Quality – Improved retention results from prompt service.

- Product Quality – A great product encourages recurring purchases and recommendations.

- Personalization and Engagement – Customers are kept interested by timely, relevant content.

- Customer Experience – The lifetime value of a customer is directly impacted by a smooth experience.

How to Increase Your LTV

It’s usually less expensive to increase your lifetime value than to find new clients. Here’s how to do it:

- Improve Onboarding – A smooth onboarding process may increase early retention, particularly for SaaS or subscription services.

- Loyalty Programs – Give devoted clients extra benefits or discounts.

- Upselling and cross-selling – Suggest upgrades or complementary products.

- Campaigns for Email and Retention – Reengage inactive users with automation.

- Offer Subscriptions – This model increases average revenue per user.

- Get Input and Take Action – Let customers know you’re paying attention.

Common Mistakes in LTV Analysis

A lot of companies miscalculate or misuse lifetime value. These are typical pitfalls:

- Applying Averages Blindly – High-value or low-value segments may be overlooked by a single average.

- Ignoring Customer Churn – Your positive LTV figures may be pointless if you have a high churn rate.

- Not Updating Models – Make sure your data reflects the changes in customer behavior.

- Neglecting CAC – If your acquisition costs are higher, a high LTV is not significant.

Knowing these details of the lifetime value can help you make better decisions and avoid costly errors.

Performance Marketing Features That Help Track LTV

Monitoring lifetime value (LTV) in performance marketing is more than just basic analytics. Tools with features designed for data-driven attribution and post-conversion analysis are necessary to understand how partnerships and campaigns affect customer lifetime value.

The following are crucial characteristics of performance marketing platforms that facilitate precise LTV tracking:

1. Complex Attribution Methods

Multi-touch attribution models can assist in accurately measuring lifetime value by attributing credit to a number of touchpoints throughout a customer journey. It provides more insight into the channels that lead to high client lifetime value.

2. Monitoring Post-Conversion Events

Look for systems that monitor client behavior after the initial purchase, such as subscription upgrades, renewals, and repeat business. This will help you in looking into the progress of customer lifetime value.

3. Analysis of Segments

You can compare LTV across different groups by breaking down your user base by campaign, region, or acquisition channel. It helps you to pinpoint high-value segments and focus on what is effective.

4. Revenue Events and Custom Goals

You can specify the company’s metrics with custom goal tracking. These distinctive indicators are important for accurately calculating lifetime value, whether they are used to track average order value or retention milestones.

5. Dashboards for Real-Time Reporting

Performance marketers can change budgets, reallocate partners, and modify campaign spend based on actual value generated rather than just initial conversions with the help of LTV insights that are integrated into the reporting dashboard.

These features are built into performance marketing platforms like Trackier, which help brands to track customer lifetime value across influencer campaigns, affiliates, and ad partners. You can move from short-term performance to long-term customer impact with the correct data in place.

Final Take

Knowing lifetime value is a requirement as well as a best practice in marketing. LTV is at the core of every sensible business choice, from determining the appropriate amount to spend on advertisements to developing your product and retention strategy.

Brands can increase ROI, strengthen customer relationships, and maintain long-term growth by accurately determining and acting upon customer lifetime value. The key is to keep improving your LTV models and concentrate on providing your clients with long-term value.

Begin monitoring this metric now, and use the data to guide your future development.

FAQs

1. What is the meaning of lifetime value?

Lifetime value (LTV) refers to the overall revenue a company might expect from a single customer throughout their partnership. It helps businesses to better evaluate customer profitability, direct acquisition tactics, and manage resources in order to keep valued customers for extended periods of time.

2. What is the difference between LTV and CLV?

LTV (Lifetime Value) and CLV (Customer Lifetime Value) are often used interchangeably. However, others define LTV as the total revenue from all consumers over time, whereas CLV relates to the value of a single client. In practice, both assess the long-term financial contribution of customers to a company.

3. What is a good lifetime value?

A good lifetime value depends on the industry, pricing model, and acquisition expenses. A healthy LTV should be at least three times the customer acquisition cost (CAC). This ratio ensures profitability, long-term growth, and the ability to invest in marketing and client retention.

4. What is the LTV period?

The LTV period is the average amount of time a client continues to buy from an organization before ending their relationship. It could last months or years, depending on the product, service, and retention measures. This time must be accurately estimated to forecast revenue and optimize client acquisition investments.