Imagine a business that spends around $25000 on marketing and gains just 100 new customers, that is $250 spent to gain each customer. If an average customer brings only $100 in revenue, the company significantly loses money. This is where understanding customer acquisition cost becomes important.

Businesses can better attribute spend, monitor campaign performance, and make data-driven decisions to control CAC with the help of a performance marketing tool.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost CAC measures the total expense required to gain a new customer. This cost is increased by every factor that contributes to customer conversion, from performance marketing tools and advertising campaigns to sales outreach. Keeping CAC under control is essential for companies looking for scale and profitability.

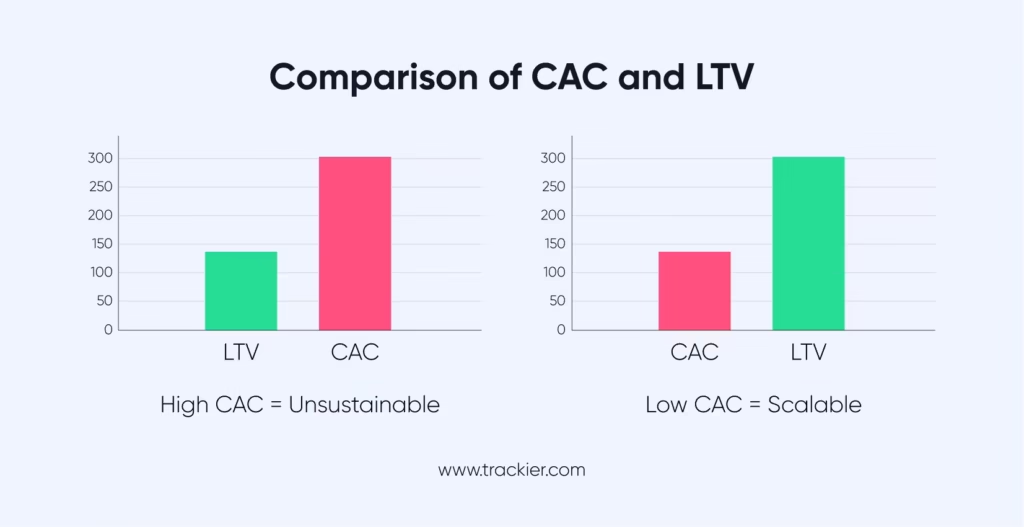

The customer acquisition cost, CAC, helps businesses figure out whether their plans will be profitable in the long run. An inefficient business model may be indicated if the cost per customer acquisition is excessively high in relation to the customer’s lifetime value (LTV). On the other hand, higher profits and practical resource use are indicated by a lower CAC.

Any business that sets a high priority on growth and profitability must have a solid understanding of customer acquisition cost.

Why is CAC Important for Your Business?

When it comes to forecasting, budgeting, and evaluating the general effectiveness of sales and marketing strategies, the customer acquisition cost metric comes in handy. Here are several reasons why CAC is important:

Revenue Planning: When the business knows its average CAC, it is easier to estimate the budget required to meet particular objectives and forecast revenue.

ROI Measurement: To calculate return on investment, businesses can compare CAC to customer lifetime value (LTV). Generally, an LTV: CAC ratio of 3:1 or higher is considered favorable.

To Evaluate the Channel: The CACs of various acquisition channels, such as partnerships, paid advertisements, SEO, and referrals, differ. Monitoring them makes it easier to determine which channel gives the cost per acquisition.

Impacts Investor Appeal: When evaluating a company’s growth potential and financial stability, investors carefully consider CAC with customer lifetime value (LTV).

Optimizes the Sales Funnel: Companies can automate or simplify ineffective steps by identifying high-cost stages in the customer journey.

Smarter Scaling Decisions: Understanding CAC allows better scaling choices. Growth might not be scalable if customer acquisition costs rise sharply as spending rises.

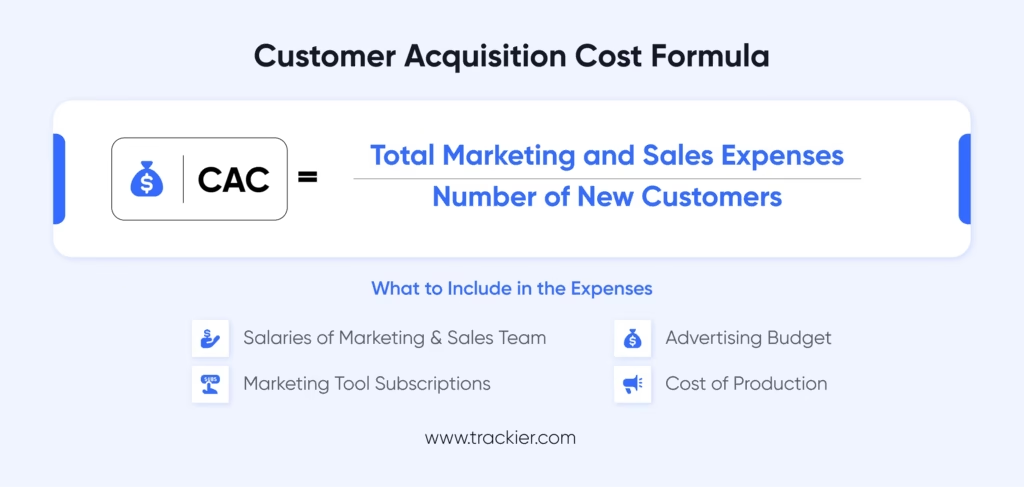

Customer Acquisition Cost Formula

The customer acquisition cost formula is very straightforward:

Here’s What You Can Include in the Expenses:

- Salaries of marketing and sales teams: This covers base pay, bonuses, and benefits for staff members who work directly with customers.

- Advertising budget: The total amount spent on paid marketing, including display ads, influencer marketing, social media campaigns, Google Ads, and traditional media placements.

- Performance marketing tool subscriptions: Price of the tools needed to manage and maximize acquisition efforts, such as campaign tracking, attribution, automation, CRM, and analytics.

- Cost of production: Costs for creating landing pages, videos, blog, creatives, and any other marketing materials that are utilized in acquisition campaigns.

- Overhead costs: A portion of office space, utilities, and administrative expenses that are proportionately distributed to the sales and marketing teams engaged in the acquisition.

When understanding how to calculate customer acquisition cost, businesses should consider both direct and indirect costs it took to acquire a customer. Many advanced businesses often calculate CAC granularly, by each campaign, product, or channel, to check which initiatives are more cost-effective.

How To Analyze Customer Acquisition Cost

Calculating CAC gives a number, but analyzing it tells us the reason behind it. To enhance acquisition performance, companies can identify inefficiencies and make better decisions by looking at CAC through a variety of lenses. Let’s look at them in brief:

- Compare it with Business Goals: Check whether your CAC aligns with long-term goals like steady profit or short-term goals like rapid lead generation.

- Analyze by Campaign: Identify how much money is being used by each channel, like paid ads, social media, SEO, etc, and which one gives the most cost-effective results.

- CAC Segmentation: Check if a certain customer group is more expensive to acquire and whether it makes sense to invest.

- Check Competitors: Compare your CAC with industry averages to look for the areas of improvement.

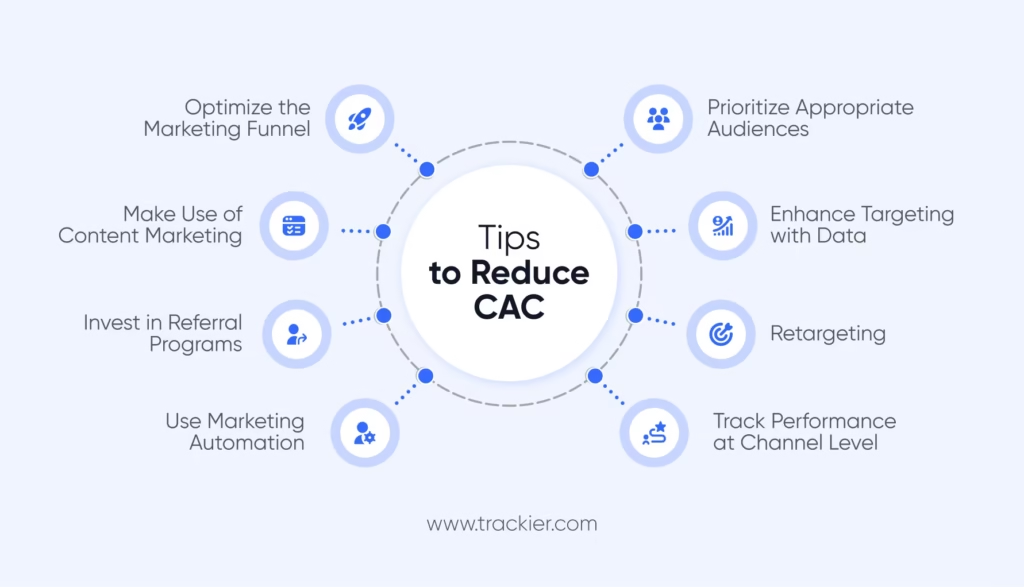

Tips to Reduce CAC

High customer acquisition costs may hamper business growth and profitability. Businesses can use the following tactics to reduce their CAC:

1. Optimize the Marketing Funnel

Faster conversions and fewer drop-offs can result from optimizing the customer journey by locating and removing hurdles. A/B testing, user behavior analysis, and heatmaps can all be used to increase conversion rates and reduce CAC.

2. Prioritize Appropriate Audiences

Describe the target markets that are interested in your products and services. It will then be simpler to interact with them most advantageously. A user who has already registered on your business’s membership website might not find value in content aimed at brand-new users.

3. Make Use of Content Marketing

Creating excellent content that is optimized for search engines can draw in organic traffic and reduce dependence on sponsored channels. Since organic leads are typically more cost-effective, inbound marketing can reduce the cost per customer acquisition.

4. Enhance Targeting with Data

Marketing teams can reach audiences who are most likely to convert by using data-driven segmentation, which cuts down on wasted ad spend. Advanced targeting tools can boost ROI and improve personalization.

5. Invest in Referral Programs

Referral marketing tactics frequently produce high-intent, low-cost leads. Referral-based customers typically have a higher retention rate and a lower CAC.

6. Retargeting

Retargeting advertisements help in re-engaging leads who did not complete a purchase. In this case, conversion rates are usually higher and CAC is lower because these users are already familiar with the brand.

7. Use Marketing Automation

Acquisition pipelines are made more efficient and less laborious by automation processes for lead scoring, email nurturing, and CRM management. This improves lead-to-customer conversion rates while lowering the expense of increasing engagement. Platforms like Trackier have marketing automation features that can help businesses personalize campaigns and track performance, and eventually reduce CAC.

8. Track Performance at Channel Level

Track the marketing channels with the highest conversion rates at the lowest cost per acquisition regularly. Efficiency is increased by reallocating funds from underperforming channels to high-performing ones.

Final Take

It is crucial to understand and manage customer acquisition costs since they affect not only the final stage but also strategic choices about marketing and sales. Businesses can create a profitable model by understanding what customer acquisition costs are, using the appropriate formula, and putting cost-cutting measures into place.

Businesses can increase the return on their marketing investments by optimizing acquisition channels, tracking CAC effectively, and matching costs to customer lifetime value.

To help these efforts, features like Campaign management on Trackier give data-driven insights that lower CAC and boost overall campaign effectiveness.

Controlling customer acquisition costs requires being proactive by conducting routine audits and testing new strategies. Businesses that think on their feet are more likely to grow while keeping CAC in check.