If you’re running marketing campaigns, on ads, email or even SEO, you have surely heard the debate: What should you care more about, ROAS vs ROI?

This blog answers that question for you.

We’ll walk through both metrics, show how they differ and where they matter most. Along the way, you’ll get hands-on formulas, real campaign examples and a simple way to decide which metric to watch depending on your goal.

Check out our affiliate marketing ROI guide that many marketers use to combine ROAS and ROI for better spend decisions.

By the end of this article, you will know exactly when ROAS does the job, and when only ROI gives you the full picture.

What exactly is ROAS vs ROI, and how do you calculate them?

What is ROAS?

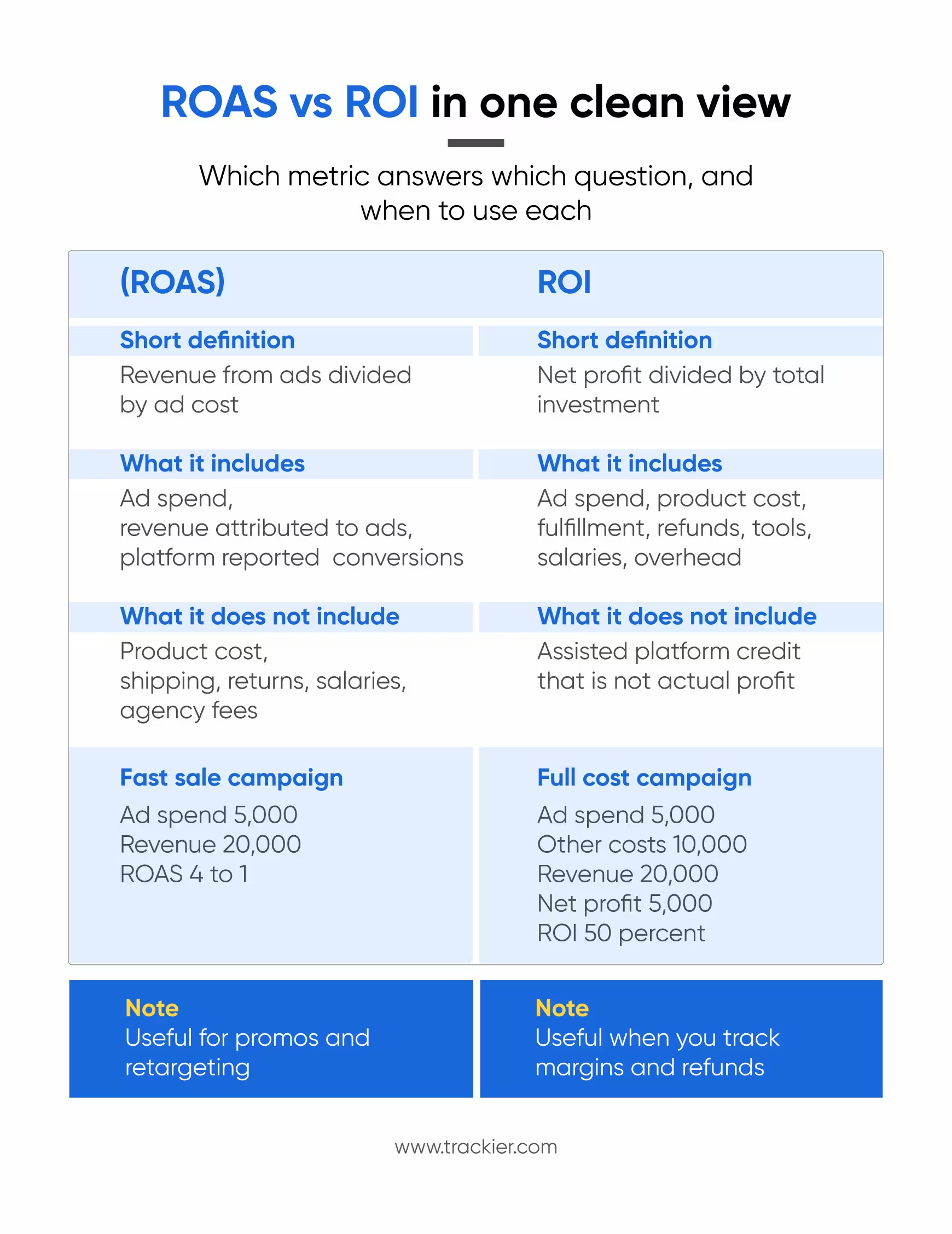

ROAS (Return On Ad Spend) tells you how much revenue you get back for every dollar you spend on advertising. It’s a ratio, often shown as “4:1” or “400%”.

Common formula:

ROAS = Revenue from ad campaign ÷ Cost of ad campaign

So if your ads cost $5,000 and bring in $20,000 in sales revenue, your ROAS is 4:1 (or 400%).

ROAS gives you a quick snapshot of ad-efficiency. It’s handy when you want to compare channels, campaigns or creatives and see which gives more bang per ad dollar.

What is ROI?

ROI (Return On Investment) goes broader; it includes all costs, not just ad spend. This can be campaign costs, production, operation overhead, staff, tools, everything.

ROI = (Net Profit ÷ Total Investment) × 100

Net Profit = Revenue generated – all costs (ads + overhead)

Using the earlier example: if your $20,000 revenue also involved $5,000 ad spend and $10,000 in other expenses (fulfilment, staffing, tools), your net profit is $5,000, giving you a 50% ROI. That means every dollar you invested brought in $0.50 in net profit.

ROI helps you see whether your marketing actually added value, not just revenue.

Why You Need Both: ROAS vs ROI Isn’t an Either/Or

ROAS gives a clean, fast signal, especially useful when you’re running ads, testing creatives or evaluating channel performance. It helps you quickly answer: “Which ad brings in the most revenue per dollar spent?”

But ROAS doesn’t tell you if the campaign was profitable overall. High ROAS can be meaningless if product costs, overheads or fulfilment eat away profits. That’s when ROI becomes crucial.

Think of it this way: ROAS checks your ad engine’s fuel efficiency. ROI tells you if you made money after the whole trip, including maintenance, tolls, and luggage costs.

If you care only about short-term ad performance, ROAS helps. If you care about overall marketing profitability and long-term sustainability, ROI is the real KPI.

When Should You Track ROAS vs ROI?

Use ROAS when your goal is immediate revenue from ads

If your goal is to know which ad, creative or placement is bringing the most revenue per ad dollar, track ROAS. It is quick to calculate and easy to compare across channels. You get a clean signal about ad efficiency, which helps when testing new creatives, bidding strategies, or audiences.

ROAS shines when you run short campaigns, promo pushes, or retargeting that needs fast decisions. It lets you answer the practical question: which ad returns the most dollars for each dollar spent. Agencies and performance teams use it to turn the dial on bids and budgets.

H3 Use ROI when you care about full profitability and long term decisions

If you need to know whether a campaign actually made money after covering product costs, shipping, tools, and salaries, you must measure ROI. ROI factors in all costs and shows net profit, not just top line revenue. That matters for pricing, channel mix, and long term budget planning.

ROI is a slower signal than ROAS. You often need more time and data to include returns, refunds, churn and overhead. But if your business cares about margins or overall profitability, ROI is the only useful metric.

H3 Quick rules you can use right away

If the campaign target is direct sales today, prioritize ROAS. If the target is sustainable revenue, profit, or lifetime value, prioritize ROI.

If you run an eCommerce flash sale, push ROAS to decide which ad creative to scale. If you plan a quarter long customer acquisition program for a SaaS product, measure ROI to include onboarding cost and churn.

These are not exclusive. Use ROAS to optimize media, and use ROI to check whether that optimization actually adds profit.

What measurement problems to watch for

Two common problems trip teams up

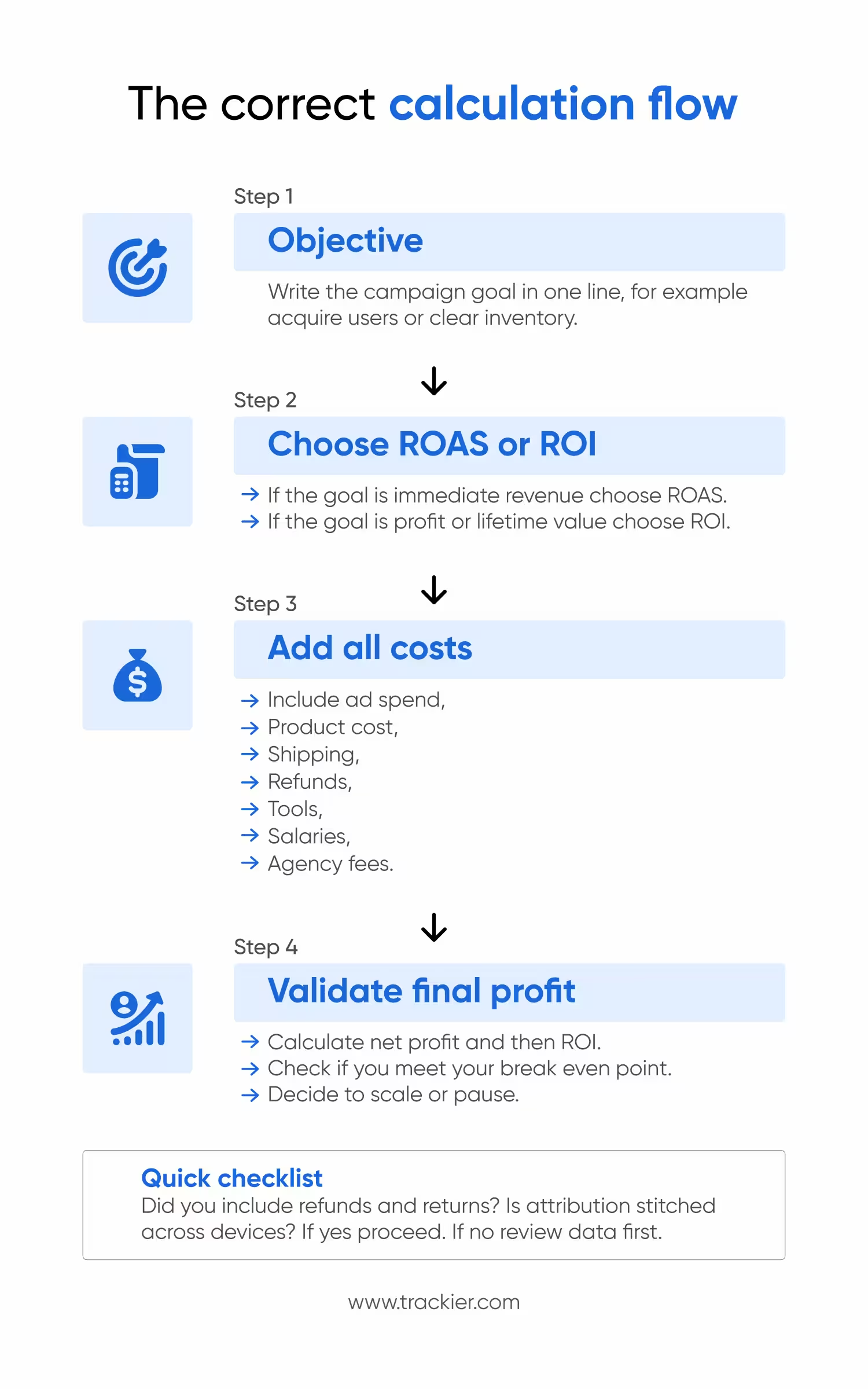

First, attribution gaps in ad platforms can misstate ROAS. You might see high ROAS on a channel while the real incremental revenue is lower because of cross device journeys or last click reporting. This is why combining data sources and user level measurement helps.

Second, forgetting hidden costs can make ROAS look deceptively good. If you ignore fulfillment costs, returns, or agency fees, you can have a high ROAS but a weak or negative ROI. That happens more than you think. Make a checklist of costs to include when you calculate ROI.

A simple decision flow you can use now–

Step 1: Decide the primary objective. Is it short term revenue or long term profit

Step 2: If short term revenue, use ROAS to compare creatives and channels

Step 3: If long term profit, add all costs and calculate ROI

Step 4: Use both metrics together. Optimize media with ROAS and validate with ROI

If you want a quick ROAS calculator, there are free tools and calculators that make this easy. They also help explain what the numbers mean for your business.

For an interactive experience, check out Trackier’s Interactive ROAS Calculator!

What Are The Common Mistakes Marketers Make With ROAS vs ROI?

Relying only on platform-reported ROAS

Many teams trust the ROAS numbers shown inside ad dashboards. These numbers often inflate results because they count assisted clicks, cross device users that are never stitched together, and last click conversions. This leads to wrong budget shifts. Cross device behaviour alone can make ROAS look higher than it is.

A better approach is to combine ad platform data with your own tracking. You can also compare against third party measurement or analytics tools. This gives you a cleaner picture of real ROAS.

Ignoring refunds and returns while calculating ROI

ROI loses accuracy if you ignore refunds, returns, discounts, shipping or support cost. Many eCommerce teams face this problem. They report positive ROI during sales, but once refunds settle, the real ROI is lower.

A simple fix is to calculate ROI only after you close the cycle for that campaign. For example, wait till the refund window is complete.

Not counting all fixed and variable costs

ROI should include everything you spend to run and sell the product. This includes salaries, content creation, tools, payment gateway fees, and your agency fee. If you miss even one of these, ROI becomes misleading.

You can create a cost sheet before you launch a campaign. This helps you avoid missing any component. Analytics guides by www.hubspot.com explain how cost layers impact ROI in a simple way.

Using the same benchmark for every channel

ROAS and ROI vary by channel. For example, search ads usually have higher ROAS for intent led terms. Social ads may have lower ROAS but better reach. Email marketing delivers a very high ROI because the cost is low.

Reports state, email delivers around 36-38 USD for every 1 USD spent. This is one of the highest ROI ranges in digital marketing.

When you compare channels, use channel specific benchmarks. Do not use one uniform target across everything.

Not separating short term and long term campaigns

Short term promo campaigns need ROAS. Long campaigns that aim for customer lifetime value need ROI. If you mix these signals, you will get confused about performance.

For example, a new acquisition campaign for a SaaS product might have low ROAS on day one, but the long term ROI can be strong if retention is good.

This is why marketers should tag campaigns clearly and track them differently.

What Are Good ROAS vs ROI Benchmarks?

Benchmarks for ROAS

A ROAS of 2-4 is often considered healthy for many eCommerce brands. Some categories like beauty, fitness and accessories push for higher. Retargeting usually brings higher ROAS because the user already knows the product.

Keep in mind that ROAS depends on margins. A brand with thin margins may need ROAS above 5 to stay profitable.

Benchmarks for ROI

ROI varies more than ROAS because every business has different cost structures. In performance driven teams, any ROI above 20-30% after all costs is seen as solid.

Email marketing is a well known outlier because the cost is very low. Reports show ROI numbers as high as 3600-3800% for many companies. This is why email often ranks high in channel mix reports.

For paid ads, ROI often improves only at scale. Smaller budgets may show weaker ROI because fixed costs stay the same.

How to set your own ROAS and ROI targets

Start with your product margin, cost of goods, shipping, support, and payment fees. Then calculate the maximum you can spend to acquire a customer while staying profitable.

This gives you your break even ROAS and your break even ROI. When you know these numbers, you no longer chase random targets. You use your actual business logic.

Conclusion–

ROAS and ROI answer different questions, but both shape smart marketing decisions. ROAS shows how well your ads earn revenue in the short run. ROI shows whether your campaigns make a real profit after every cost. When you use both together, you get a full picture of performance. You know which channels to scale, which campaigns need a fix, and which ideas are worth repeating.

This approach works for every business model. eCommerce, apps, BFSI, travel, education, SaaS, all depend on accurate measurement. The teams that grow faster are the ones that treat ROAS as a media guide and ROI as the final truth. If you track both with care, your budgets work harder, and your marketing becomes predictable.

What To Do Next?

Start by listing your current campaigns and identifying which ones need ROAS and which ones need ROI.

Create a simple cost sheet that includes product cost, tools, agency fees, refunds, and all hidden costs. This helps you avoid false positives.

Next, run small tests on creative, audience and placement to improve ROAS. Once you find a winning structure, scale slowly and monitor ROI. Track both metrics over a full cycle rather than only at the start. If you keep this routine steady, you will see cleaner data and steady improvement.

Hungry for more? Download our free case studies that cover real stories.

Or sign up for the Trackier’s newsletter to get weekly best practices on referral programs and partner marketing.

FAQs

1. What is a good ROAS for most businesses?

A good ROAS depends on your margin, but many brands aim for a ROAS between 2 and 4 for regular campaigns. Retargeting campaigns can push higher because users already know the product. Some industries, like beauty and fitness, often see stronger ROAS due to impulse buying.

It is important to compare your ROAS with your break-even point. If your margin is thin, you may need a ROAS of 5 or more to stay profitable.

2. What is a good ROI for marketing campaigns?

A profitable ROI is usually anything above 20-30% after all costs, but this varies depending on your industry. Email marketing is a well known exception because the cost is low. Reports show ROI between 3600 and 3800% for many companies, which is why email stays a top channel.

ROI should always include fixed and variable costs. Once you calculate your full cost base, you can set realistic ROI targets.

3. Why is ROAS not enough for long term success?

ROAS only measures revenue compared to ad spend. It does not reflect refunds, discounts, cost of goods, tools, or salaries. This can make a campaign look successful even when it loses profit. That is why ROAS works best for short term optimisation.

For long term decisions, you need ROI because it captures real profit. Without it, you may scale a campaign that looks strong on paper but performs poorly once all costs settle.

4. When should a business focus more on ROI?

A business should focus more on ROI when margins are tight, when the product has high fulfilment cost, or when the goal is long term sustainability. ROI helps you understand the real value of a customer after operational costs.

This is especially important for SaaS, subscription models, or brands with high return rates. These models require accurate cost tracking to stay profitable.

5. Can ROAS and ROI ever be used together?

Yes, many high performing teams use both together. ROAS helps with short term optimisation. You can test creatives, audiences, keywords and placements using ROAS. Once you find winners, you review ROI to check if the performance is profitable.

This combined approach reduces risk. It also keeps your budget aligned with business reality. It is common for growing teams to track ROAS daily and ROI weekly or monthly. This is widely recommended by many performance marketers and analytics blogs online.