The global partner marketing industry is evolving fast, from affiliate marketing to new channels like influencer marketing and retail media networks (RMNs). The industry is growing with strong regional expansion and stricter global regulations.

At $18.5 billion today, it is expected to reach $31.7 billion by 2031. To tap into this growth, businesses can not afford to just translate content; they require full operational and technical localization.

This report shows that localization is a requirement, no longer optional. It is based on four key areas:

- Regional engagement strategies tailored to specific audiences in each market.

- Server-side tracking (SST) to ensure accurate and compliant attribution.

- AI-driven personalization to enhance the customer experience.

- Automated systems to manage complex global compliance and payments.

With different data privacy regulations and regional variations in ad fraud, platforms that offer centralized control over data and strong protection against attribution fraud are crucial.

Trackier helps businesses to implement these solutions effectively, ensuring data integrity and ROI across global markets.

To succeed in fast-growing markets like the Asia-Pacific (APAC) and emerging RMN channels, brands need precise, localized tracking and performance management.

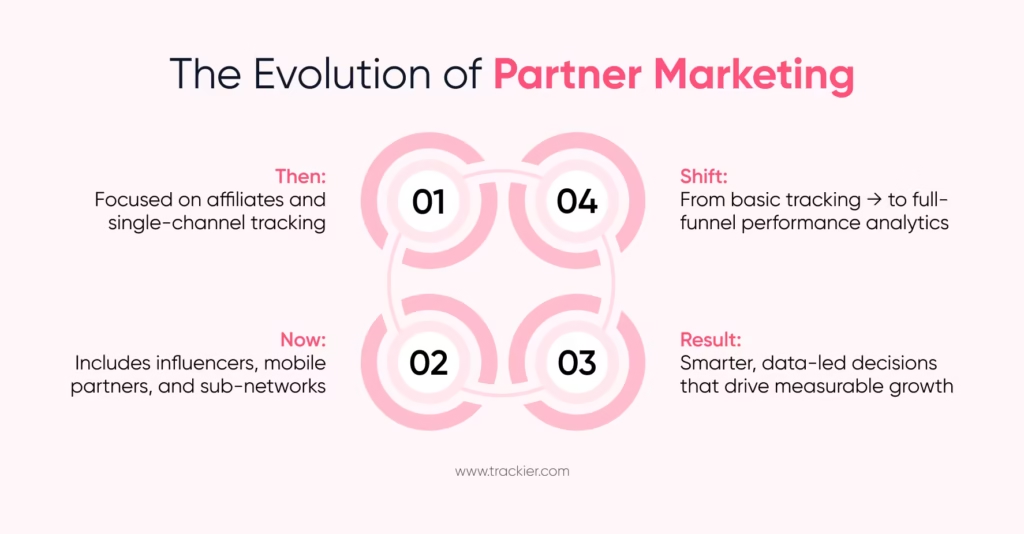

The Shift in Global Partner Marketing

The partner marketing ecosystem today is broader and more technologically advanced than the traditional affiliate program. Today, partner marketing includes mobile marketing, influencers, as well as complicated sub-networks.

Modern platforms have a full solution for performance marketing, and the focus is on tracking and multi-channel analytics, with businesses getting a better view of actual performance and marketing growth decisions based on data.

The market growth indicates its strategic performance. Today, the global affiliate marketing industry is worth $18.5 billion and is growing due to adoption by businesses and content creators. By 2031, it is projected to be worth $31.7 billion for an 8% CAGR from 2024 to 2031.

In the U.S, specifically, partner marketing contributes about 16% of all e-commerce sales. North America is the largest market and represents more than 40% of global revenue. Mature markets are saturated and are presenting challenges, which is why high-growth regions are becoming increasingly important.

Importance of Localization: Balancing Global and Local Needs

A successful global campaign requires finding a balance between centralized brand control and local tuning. A decision must be made on when to utilize global assets versus developing content specifically for a local audience.

Partner programs are an effective method for entering new markets without a huge investment. Local affiliates provide cultural familiarity and knowledge of regulations for brands to navigate complex rules around GDPR in Europe, the EU ViDA reform, and regional VAT/GST regulations in Latin America and Asia. This reduces the risk of compliance issues and hefty fines.

Growth trends also point to an area of investment. Although the global market is growing at an 8% CAGR, many areas are expanding much faster; for example, influencer marketing (33.11% CAGR).

Brands should focus on these high-velocity areas, in which they will prioritize creating localized tracking systems and building partner infrastructure to support fast and compliant growth, not just looking to mature markets like North America.

Regional Assessment: Smart Strategies For Global Partner Growth

To expand on a global scale, everyone must understand the differences in how each region operates. Each market will demonstrate its nuances in performance, risks, and operational rules.

Localization extends beyond language considerations to how different partnership structures and technical solutions efficiently adapt to local conditions for all market participants.

North America and EMEA Regions: Mature Markets and Rules That Matter

The North American partner market is large, competitive, and mature, with major advertisers spending on affiliate marketing. While these are mature markets, they have risks.

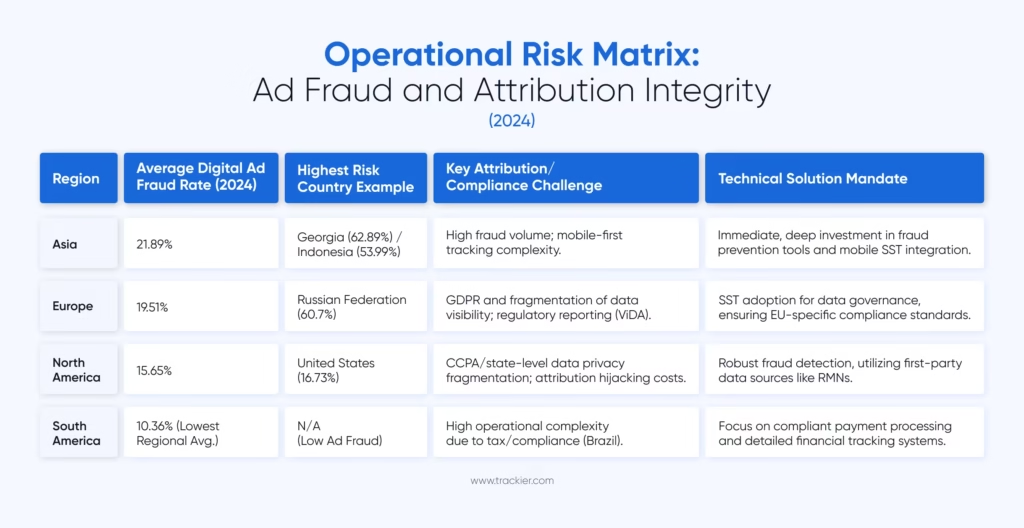

The digital ad fraud rate in the U.S is 16.73% signalling the need for even the best fraud prevention software to protect budgets from fake advertising and unauthorized commissions.

Fraud in the EMEA (Europe, Middle East, and Africa) is higher; the estimated cost of fraud in these markets is 19.51%. Additionally, legalities (GDPR) as well as the upcoming ViDA (Digital Age VAT Reform), make compliance even more important.

ViDA will require real-time reporting of specified digital activity, cross-border e-invoices, and introduce liability for online platforms for mistakes in VAT treatment. To operate properly and safely in the market, brands will need to carefully monitor compliance.

Asia-Pacific (APAC): Fast-Growing Mobile Markets

APAC is the fastest-growing area of performance marketing, with a market forecasted to grow from $4.3 billion in 2024 to $8.3 billion by 2031 (10%+ annual growth).

Mobile is pushing this growth; more than 60% of affiliate traffic is from mobile devices. Thus, advertisers need to focus on mobile-first campaigns and mobile tracking.

APAC’s affiliate ecosystem is different. Japan, South Korea, and China, for example, often utilize sub-affiliate networks directly integrated into SaaS tracking platforms.

International advertisers will need to select networks with care and have a strong relationship with sub-affiliate networks.

Along with high growth, risk also comes. APAC also has the highest digital ad fraud rate at 21.89%. This is among the highest of any region; thus, using fraud prevention software having real-time detection is necessary to ensure revenue is real and sustainable.

Latin America (LATAM) and Emerging Markets: Big Potential, Complex Rules

Countries such as Brazil, India, Mexico, and Turkey are excellent growth markets for organizations established in North America and Europe. For example, Brazil is one of the top 10 countries for affiliate sales.

Due to resource constraints, competition is less of a factor in these regions, which will allow organizations to acquire market share more rapidly.

Fraud is also much less in these regions (10.36% fraudulent transactions in South America), while regulatory constraints are stronger than in the United States. Countries like Brazil and Turkey have a high burden for compliance with VAT/GST, which increases operating costs.

Localization also matters when it comes to financing methodologies. Average order value (AOV) varies across markets, and therefore, using the same global commission rate is not an efficient way.

Tracking systems should not just be directed to AOV, but also to facilitate localized commissions to optimize for return on ad spend (ROAS) instead. This approach also increases profitability since various regional markets are more profitable for different reasons.

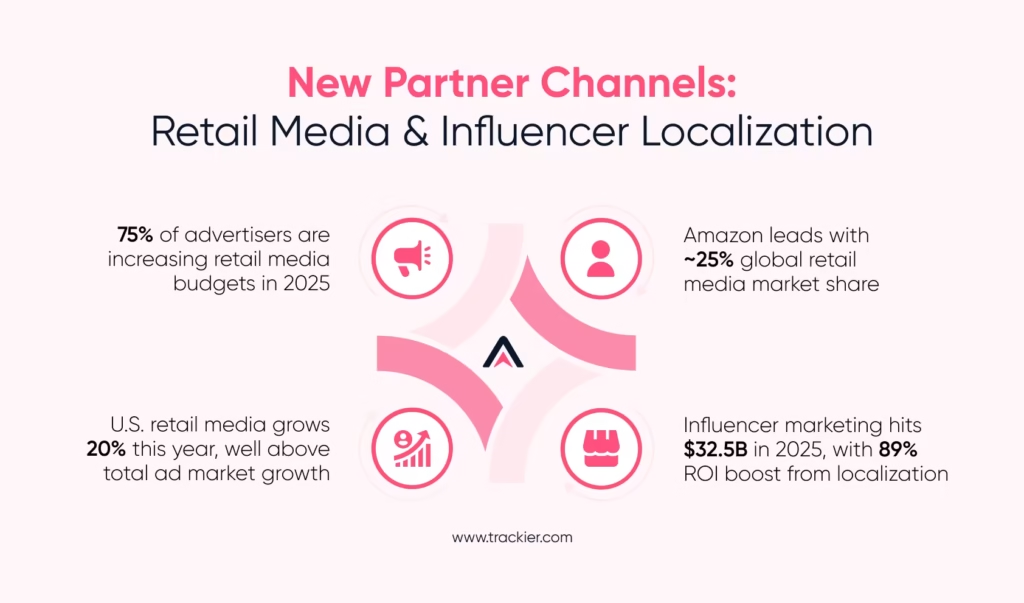

New Partner Channels: Retail Media and Influencer Localization

The definition of partner marketing is being expanded by two rapidly growing channels that each rely heavily on localized data and content: Retail media networks (RMNs) and the influencer economy.

Rise of Retail Media Networks (RMNs) Globally

Retail media networks (RMNs) are taking over the digital advertising space by allowing marketers to get right down to consumer targeting and measure direct sales.

In the U.S., retail media is expected to grow 20% in 2025, outpacing the overall ad market’s growth of 4.3%. Worldwide, 65% of marketers plan to spend more money on RMNs in the next year.

It is a powerful tool because it utilizes first-party data collection provided by retailers, including purchase data and demographic information. This is especially pivotal now as privacy regulations and browser changes are reducing the use of third-party cookies.

RMNs allow marketers to spend on first-party data and ensure they are compliant and still have an effective campaign while their local targeting is still enabled, even with outside data sources diminishing.

It also simplifies the measurement of results. Marketers can directly link sales, whether by revenue or by units sold, to their campaigns, making calculations of ROI less complex. At the same time, RMNs are advancing rapidly, as it is not just simple onsite banners anymore.

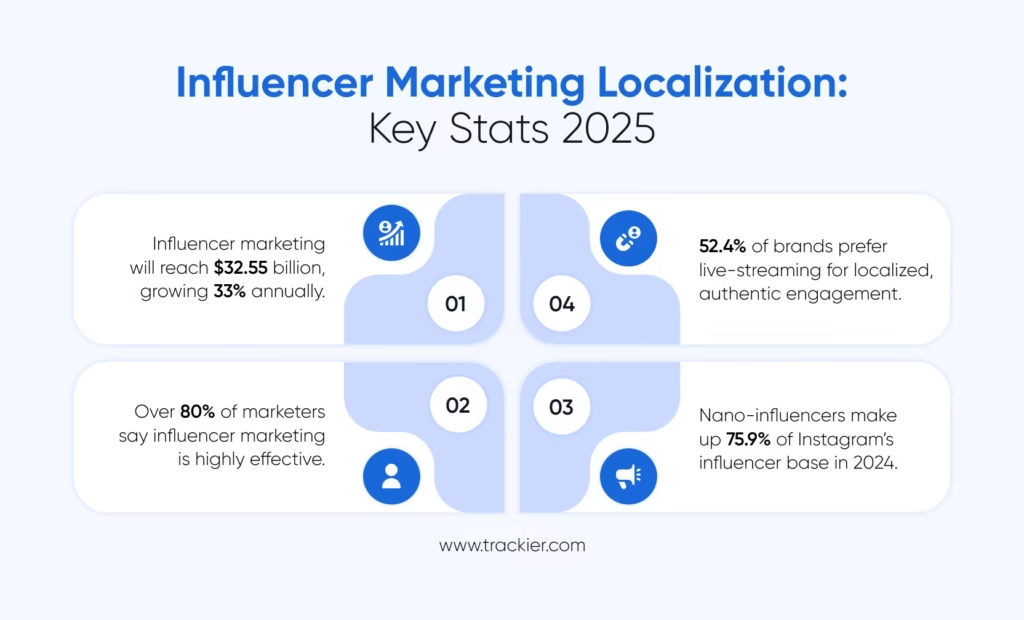

Influencer Marketing Localization: Staying Relevant at Scale

Influencer marketing is growing at a fast rate, and it is projected to reach $32.55 billion in 2025, with a 33% growth rate annually. More than 80% of marketers say that influencer marketing is an effective way to reach goals.

The trend behind this is based on authenticity and hyper-local relevance. The global trend favors smaller, highly contextual partners. In fact, nano-influencers made up 75.9% of Instagram’s influencer base in 2024.

True localism necessitates engaging these smaller, geographically bounded content creators, who drive highly contextual and trusted conversions in their own specific local communities.

With this prioritization of local relevance, the content strategy must also become more flexible. Live-streaming has become the preferred content type, utilized by 52.4% of brands.

This shows that a strategy prioritizing the localization of content must focus on real-time, interactive formats that create a connection with local audiences, rather than static creative solutions.

The logistical issues associated with speed and scale are considerable. The rate of growth is fastest when there is management of thousands of geographically dispersed, small-scale partners.

To effectively scale global influencer programs, an affiliate tracking software is essential to onboard, measure performance, and pay each partner.

Technology as the Foundation for Global Trust and Data Integrity

With data rules becoming more restrictive and more marketing channels than ever before, technology is the crucial factor that determines whether a business can remain compliant and grow on a global basis.

Attribution Challenges and the End of Client-Side Tracking

Performance marketing now has a major problem worldwide because of new privacy rules and technological changes. Regulations like the GDPR in Europe and the CCPA in California are limiting the ways that brands can collect and use personally identifiable information.

Because of these restrictions, effective tracking has suffered. In addition to restrictive legalities on what information companies can collect, many customers are now using ad blockers or browsers that limit the view into the customer journey, which restricts or completely eliminates the brand’s ability to gain insights into customers.

The limited data means brands can not define and measure true value in either their partners, affiliates, or sources based on the limited data, and this intended or unintentional misinformation creates perceived value versus performance, attribution, and sales effort.

To make tracking more difficult, attribution fraud (like attribution hijacking or shady browser extensions) would let any marketer take credit for a sale. Additionally, fraud and hijacking waste marketing budgets, and in the end, you have poor attribution, once again.

Strategic Solution: Server-Side Tracking (SST) for Compliance and Control

Server-side tracking is the ultimate in solving your attribution challenges and providing the data you need to feel confident you are compliant with global privacy rules.

Unlike the client-side tracking that relies on browser scripts (and is blocked or restricted easily), SST sends user data consumed by the brand through their own servers first, making the brand the true owner and controller of end-user data.

Another big win of SST is localizing. Each region has different privacy and data requirements, and SST satisfies front-end tracking management to process the collected data following local data privacy requirements.

For example, Europe has strict data minimization standards. Brands can filter and prepare user information before passing along data to third-party platforms.

Without this control, the worldwide growth creates exposure to legal threats and inappropriate performance reporting. But, with SST, brands can use accurate, timely tracking and reporting data to establish ROI and further drive profit across global markets accurately.

Fighting Fraud in Specific Regions

The rates of fraud vary globally, meaning that a single, global approach to prevention won’t work. Regions require their own unique methods of prevention.

For instance, fraud rates can reach very high levels across emerging markets; Indonesia has a 53.99% rate, and Nigeria’s rate is 45.78%.

However, entering into the new markets is only possible with the best performance marketing software, which demonstrates the ability to attribute correctly.

When fraud is not controlled, ROI can quickly be reduced, demonstrating that advanced and future-looking fraud prevention is important in any new market opportunity.

A global brand hoping to grow must be mindful of fraud risk and invest in technology, and rely on real-time fraud monitoring in high-fraud-risk markets to protect its marketing budgets.

Operationalizing Global Payout and Regulatory Compliance

The final aspect of the localization imperative is financial transaction and global tax compliance operational friction points. Functions normally treated as back-office capabilities have embedded themselves into competitive partner marketing operational infrastructure.

Localized Payout Mechanisms and Factors of Affiliate Retention

The foundation of successful, scalable partner marketing trust is built by competitive, transparent commission rates, reliable tracking, and consistent financial support. The ability to manage localized payouts efficiently is essential for affiliate retention in global programs.

Successfully globalizing the localized payout function requires tracking platforms to have financial flexibility that can also account for regional preferences with lower-cost payment options specific to the affiliate’s country. Advanced platforms will also need to handle complex logistics and support payouts in a selection of 120 currencies in 200+ countries.

As per the report, most affiliate programs offer flat-rate payments (CPA, 49%) or a percentage of the sales (CPS, 42%), but the difference in conversion rates and average order value (AOV) per region means that these payment models will need to have sufficient flexibility.

A platform that eliminates barriers to payment and provides a better, trust and locality-based financial infrastructure to meet affiliate needs, presents a strong opportunity to remain competitive and improve the acquisition and retention of affiliates in areas of the world where bank transfers or centralized USD payouts are inefficient or non-standard.

Global Tax and Regulatory Compliance

Enterprises that manage global partner programs must navigate an increasingly complex tax regarding VAT/GST on cross-border e-commerce transactions. The compliance burden varies on a global scale.

As per the report, some countries can be almost nonexistent (e.g., Singapore, 2 on the burden scale), whereas others (emerging markets like Brazil and Turkey) score very high (7 out of 10) and may require very deep administrative burdens/resources.

Worldwide governments are implementing stricter controls, which shows a clear shift in liability. The EU’s ViDA reform proposes that online platforms are, for example, responsible for VAT liability, meaning that tax responsibility for vendors becomes exposure liability for the platform operator.

At the same time, countries like India are increasing their enforcement on GST fraud to identify significant tax evasion, and then new e-invoicing requirements are being expanded to increase the number of companies required to use e-invoicing.

Starting in January 2025, businesses in Germany will also be required to use e-invoicing for B2B transactions. This means that compliance tracking and automated localized tax reporting are no longer an optional duty of the finance team.

It’s now a mandatory integrated feature of the performance marketing software and is involved in access to global markets and financial security through reduced risk for regulatory exposure.

Conclusion: The Future of Hyper-Localized Partner Growth

The projected growth of the global partner marketing sector is expected to be $31.7 billion by 2031, emphasizing the fundamental importance of performance partnerships in driving enterprise revenue.

However, to achieve and maintain market leadership in an expanding ecosystem, the industry requires a shift from mass, general global campaigns to an integrated, technological, localization strategy.

The analysis confirms that the success in a sustainable market will require the integration of four crucial pillars:

- Differentiated regional strategy – The ability to recognize and proactively shape a critical market of distinct market dynamics, network structures, and fraud profiles; specifically, the mobile-first, high-growth APAC market, and the heavy compliance EMEA market.

- Server-side tracking (SST) – This will be the dominant technology for implementation to enable compliance with data governance and restore attribution in a cookieless world. SST is important for brands to comply with and operate under GDPR, CCPA, and other local data compliance restrictions.

- AI-driven personalization – Moving beyond basic localization that is static and basic, and leveraging machine learning can recalibrate offers and content continuously on a real-time basis as regional consumer trends shift to maximize conversion velocity.

- Automated compliance and payment infrastructure – Connecting financial technology that will manage competitive, multi-currency payouts, and automate localized tax and regulatory compliance reporting for all types of mandated compliance (e.g., EU ViDA and regional e-invoicing). This will enable the enterprise to prevent growing regulatory liability and provide comprehensive global affiliate retention.

The complexity of navigating high regional fraud rates (21.89% in Asia), the burden of high tax compliance (as in Brazil – 7/10), and the fast-paced scale of high-speed channels like RMNs and nano-influencer programs, with a platform that enables centralized control, advanced analytics, and comprehensive fraud controls.

The enterprise that successfully solves the technical localization challenges will be well-positioned to scale its global partner programs securely and fully participate in the industry’s projected value of $31.7 billion.