In performance marketing, every click, conversion, and customer interaction contributes to your overall return on investment. Advertisers don’t just want visibility, they want measurable growth. To achieve this, it’s crucial to understand how every dollar spent contributes to real business outcomes. But not all metrics show the full picture. Two of the most critical and often misunderstood metrics in growth marketing are CPA vs CAC, each offering a different perspective on how efficiently your marketing efforts turn prospects into paying customers.

Although both measure “acquisition,” they operate at different levels of the marketing funnel, serve different purposes, and impact ROI in completely different ways. Understanding CPA vs CAC is essential if you want to scale profitably, optimize spend intelligently, and ensure your acquisition strategy is sustainable.

What Is CPA?

CPA measures how much you spend to generate a single conversion from a specific campaign or channel.

This “acquisition” can refer to:

- Lead generation

- App install

- Sign-up or registration

- Purchase or sale

- Subscription trial

- Any action defined as a conversion

CPA = Total Campaign Spend/Total Conversions

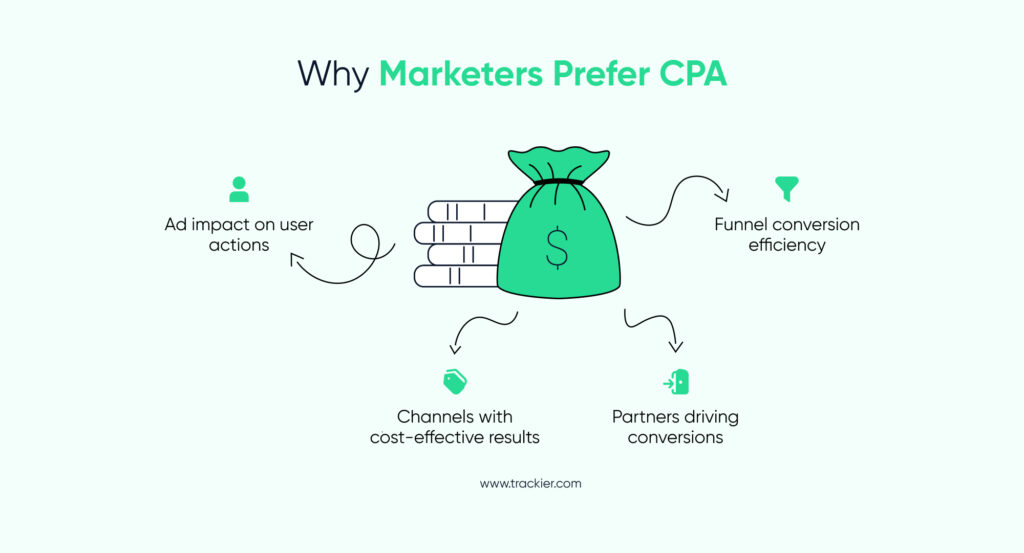

Why Marketers Prefer CPA

CPA focuses purely on campaign efficiency. It reveals:

- Which partners are driving real conversions

- Which channels deliver cost-effective results

- How well your ads influence user actions

- Whether your landing page or funnel converts effectively

CPA is especially popular in affiliate marketing, app install campaigns, partner programs, and influencer performance campaigns where conversions are the final goal. If your goal is performance-driven growth, CPA is your primary metric.

What Is CAC?

CAC tells you the total cost of acquiring one paying customer, not just through ads, but through your entire marketing and sales engine.

CAC accounts for:

- Paid campaigns

- SEO & content cost

- Sales team salaries

- Tools & software

- Marketing overhead

- Agency & creative fees

- Retargeting & remarketing spend

CAC = Total Sales + Marketing Costs/Total New Customers

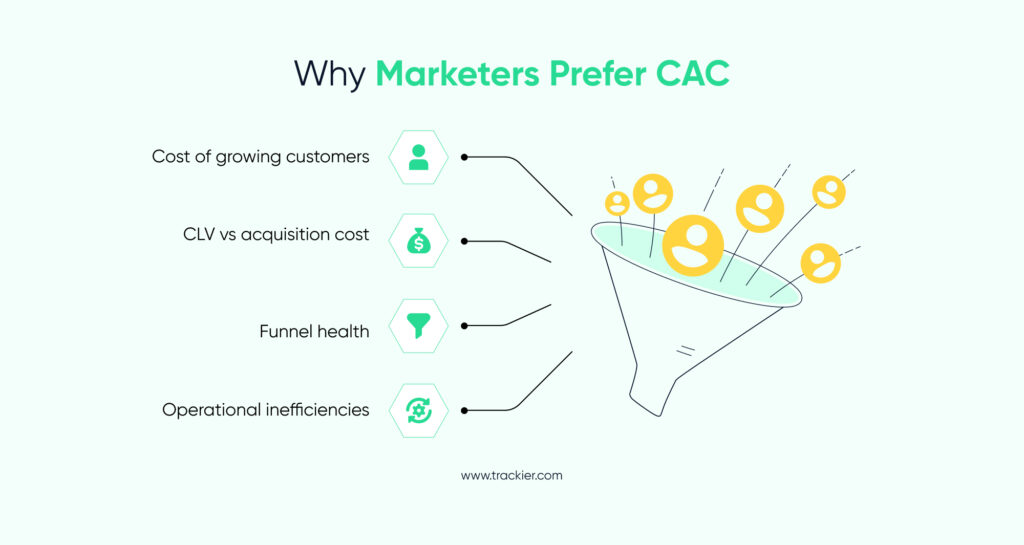

Why Marketers Prefer CAC

CAC measures profitability and long-term growth sustainability. It helps you understand:

- How expensive it is to grow your customer base

- Whether your CLV justifies acquisition cost

- How healthy your funnel is

- Where operational inefficiencies exist

If you want to scale a profitable business, CAC is non-negotiable.

CPA vs CAC: Key Differences for Better ROI

Even though they sound similar, each metric captures a completely different aspect of how efficiently your business acquires users or customers.

| Aspect | CPA | CAC |

| Definition | Cost to acquire a conversion | Cost to acquire one paying customer |

| Scope | Campaign-level | Business-level |

| Includes | Only ad spend | Ad spend + salaries + tools + overheads |

| Purpose | Optimize campaign performance | Measure profitability and growth viability |

| Timeframe | Short-term | Long-term |

| Best For | Performance marketers | Growth and revenue teams |

The Most Important Difference

CPA tracks the cost to get an action.

CAC tracks the cost to get a customer.

They are connected, but not interchangeable.

How CPA Affects CAC

CPA impacts CAC directly. Lowering CPA usually reduces CAC, but that’s not always the case. Before looking at how these metrics behave in real scenarios, it’s important to understand how CPA directly influences, but does not fully determine, CAC.

While CPA reflects the immediate cost of generating a conversion from a marketing campaign, CAC captures everything that happens after that conversion: nurturing, sales efforts, onboarding, and turning that lead into a paying customer. This means even the most efficient campaigns can produce expensive customers if the funnel is weak, misaligned, or resource-heavy.

At the same time, a slightly higher CPA can still result in a low CAC if the conversions are high-intent and require minimal effort to close. In short, the relationship between CPA and CAC is dynamic, and understanding it helps businesses optimize both cost efficiency and customer quality.

For example:

- You might have a low CPA from a campaign, but if lead quality is poor, your CAC shoots up because your sales team needs more time and resources to convert them.

- You might have a high CPA but strong lead intent, lowering your overall CAC because the conversion-to-customer rate is higher.

Understanding this relationship helps you balance volume vs quality.

Why Measuring CPA vs CAC Is Crucial for ROI

CPA tells you if your campaigns are profitable

- Did the ad deliver a meaningful action? Was the conversion worth the cost?

CAC tells you if your business model is profitable

- Can you sustainably acquire customers? Does the revenue cover the total acquisition cost?

Both Together Tell You Where to Optimize

High CPA & high CAC – Bad funnel performance

Low CPA & high CAC – Strong ads but poor sales process

High CPA & low CAC – Quality conversions but expensive campaigns

Low CPA & low CAC – Ideal scenario for scalable growth

Which Metric Should You Prioritize?

Prioritize CPA when you want to:

- Optimize campaign performance

- Improve conversion rates

- Scale affiliate or partner programs

- Reduce wasted ad spend

- Test offers, creatives, or audiences

Prioritize CAC when you want to:

- Build long-term profitability

- Evaluate the cost-effectiveness of your entire funnel

- Plan budgets and forecast revenue

- Identify operational inefficiencies

- Scale sustainably

How CPA and CAC Function Across the Customer Journey

Understanding how CPA and CAC function within the customer journey is essential before comparing them in real-world scenarios. Both metrics serve different phases of the acquisition funnel, and together they create a full-view performance framework that shows where your spend is working, and where it’s failing.

How CPA Functions in the Funnel

CPA operates at the campaign level, meaning its function is tied to the efficiency of specific marketing activities. It tells you:

- Which channels bring the highest-intent conversions

Whether it’s affiliates, paid ads, influencers, or mobile channels, CPA reveals which touchpoints are delivering meaningful actions for the lowest cost.

- How well your creatives and landing pages perform

A strong click-through rate is wasted if your landing page cannot convert. A rising CPA often signals friction inside your funnel.

- How partner quality impacts performance

With platforms like Trackier, marketers can identify which publishers drive genuine conversions versus those inflating traffic or sending low-quality leads.

- How efficiently your campaigns drive bottom-funnel actions

Since CPA is tied directly to revenue-impacting actions it helps marketers keep campaigns ROI-focused and conversion-optimized.

Overall, CPA’s main function is to measure the effectiveness of your marketing spend at generating specific actions.

How CAC Functions in the Funnel

Unlike CPA, CAC extends far beyond campaign performance and considers the entire ecosystem involved in turning a lead into a paying customer.

- Evaluates the true economic cost of growth

Even if your ad campaigns perform well, inefficient sales teams, long onboarding cycles, or high support overhead can inflate CAC.

- Provides a full-funnel profitability view

CAC reveals whether your acquisition engine, ads, sales, marketing, tools, and operations, is sustainable and scalable in the long run.

- Highlights resource inefficiencies

High CAC often signals deeper issues such as:

- Weak lead nurturing

- Long sales cycles

- Unqualified audiences

- Overstaffed functions

- Overdependence on paid channels

- Shows alignment between marketing & revenue

CAC ultimately answers the question: Are we spending more to acquire a customer than the revenue they bring in? This makes CAC a strategic metric, essential for growth leaders, founders, and finance teams.

How CPA and CAC Work Together

The real power of these metrics emerges when they’re evaluated side by side. The real value of understanding CPA vs CAC comes from seeing how the two interact across your customer journey. While both measure acquisition efficiency, they influence different business decisions and reveal different types of bottlenecks. When evaluated together, they provide a powerful, holistic view of performance, quality, and profitability.

- CPA shows how efficiently you’re generating conversions – A low CPA indicates that your campaigns, creatives, targeting, and funnel are working cohesively to drive actions at a cost-effective rate. It shows that your ads resonate with your audience and your landing pages are optimized for conversions. However, a low CPA alone doesn’t guarantee business success, if the conversions are low-quality, uninterested, or hard to close, your CAC will remain high. This is why CPA should always be evaluated alongside deeper funnel outcomes, not in isolation.

- CAC shows how efficiently you’re creating paying customers – CAC brings broader visibility into the full journey, from first touch to becoming revenue-generating customers. It takes into account sales cycles, nurturing workflows, overhead costs, and operational resources. A rising CAC often signals issues such as misaligned messaging, poor user experience, or inefficiencies in the sales process. Even small gaps in lead follow-up, onboarding timelines, or product education can materially increase the cost of acquiring a customer. CAC forces businesses to examine their organizational efficiency, not just marketing outcomes.

Together, they help identify:

Which channels need optimization : When CPA is low but CAC is high, it suggests that the marketing channel is bringing in quantity but not quality, meaning optimization must shift toward improving targeting, lead scoring, and qualification. When CPA is high and CAC is low, it indicates that although conversions are costly, they’re extremely high-intent and convert effortlessly into customers, meaning the channel might be premium but profitable.This combined view helps you allocate budget to channels that balance both quality and cost, ensuring long-term ROI.

Whether lead quality aligns with customer quality : Some channels may generate thousands of cheap leads, but only a tiny fraction convert to customers. Others may generate fewer leads at a higher CPA, but nearly all convert. Comparing CPA and CAC side-by-side highlights these patterns instantly. It helps you answer questions like:

- Are our cheapest leads actually our most expensive customers?

- Does a lower-volume channel deliver higher customer value?

- Is our lead scoring aligned with real customer behavior?

This alignment is crucial for predictable revenue and sustainable scaling.

If your sales and marketing teams are aligned : Misalignment between marketing (which focuses on CPA) and sales (which focuses on closing paying customers) can inflate acquisition costs. If marketing delivers leads that sales teams cannot convert, CAC rises. If sales teams delay follow-ups or lack the right enablement, even high-quality leads become expensive to close. Tracking CPA and CAC together ensures both teams work with shared metrics, shared goals, and a shared definition of a “qualified” prospect.

Whether your growth model is scalable : A business can scale only when both CPA and CAC remain stable, or ideally, decrease, as volume increases. If CPA rises with scale, campaigns need optimization. If CAC rises with scale, internal inefficiencies must be addressed. When both remain healthy as you raise ad spend, onboard new partners, or expand your funnel, it signals that your acquisition model is truly scalable and ready for growth.

Why This Functional Relationship Matters

Before diving into practical examples and calculations, it’s essential to understand that CPA feeds into CAC, but CAC determines true profitability. A campaign may look efficient on paper through its CPA, but only CAC reveals whether the effort results in customers who generate sustainable revenue.

CPA vs CAC: Practical Example

Let’s say you run a campaign that delivers:

100 leads

CPA = $10 – Spend = $1,000

But only 10 of those leads become paying customers, and your total marketing & sales cost is $5,000.

CAC = $5,000/10 = $500 per customer

This means:

- Your CPA looks excellent ($10 per lead)

- Your CAC looks poor ($500 per customer)

This tells you the issue isn’t the campaign, it’s the conversion funnel.

How Trackier Helps Reduce CPA & Optimize CAC

Trackier’s performance marketing platform is built to help brands and networks improve acquisition costs at every stage.

Trackier Helps Lower CPA With:

- Deep click & conversion attribution

- Fraud detection to eliminate invalid traffic

- Transparent publisher-level insights

- Automated campaigns & payouts

- Multi-channel tracking for performance optimization

- Real-time data to allocate budget strategically

Trackier Helps Lower CAC With:

- Full-funnel visibility to understand customer journeys

- Quality scoring for leads and partners

- Better partner evaluation to eliminate low-value sources

- Unified analytics for improved decision-making

- Reduced revenue leakage and operational inefficiencies

With Trackier, you can connect the dots between campaigns, conversions, customers, and revenue, maximizing ROI while controlling costs.

The Growth Takeaway

Understanding the difference between CPA vs CAC is essential for any marketer serious about growth. CPA reveals how efficiently your campaigns drive conversions. CAC reveals how efficiently your business turns those conversions into paying customers.

If you want long-term success, you need to optimize both.

With Trackier’s advanced tracking, attribution, and performance analytics, brands and networks can accurately measure CPA, reduce CAC, eliminate fraud, and allocate budgets toward the highest-performing partners and channels.

Smart insights – Lower cost – Higher ROI – Sustainable growth.

FAQs

What is the main difference between CPA and CAC?

The biggest difference in CPA vs CAC is scope. CPA measures the cost of generating a specific conversion (like a signup or purchase), while CAC measures the total cost of turning a lead into a paying customer. CPA is campaign-focused, whereas CAC is business-focused.

Why is CPA vs CAC important for marketing ROI?

Understanding CPA vs CAC helps marketers see both campaign efficiency and overall profitability. CPA shows whether ads drive cost-effective actions, while CAC reveals whether those actions convert into profitable customers. Together, they ensure growth strategies are measurable and sustainable.

How does CPA influence CAC?

In the CPA vs CAC relationship, CPA acts as the starting point. A low CPA can help reduce CAC, but only if lead quality is strong and the sales funnel is efficient. Poor lead nurturing or misaligned targeting can still increase CAC even when CPA is low.

Which metric should marketers optimize first, CPA or CAC?

Both matter, but CPA is usually optimized first because it controls immediate campaign costs. Once CPA is healthy, teams focus on reducing CAC by improving sales processes, qualification, and operational efficiency. This layered approach delivers the best results in CPA vs CAC analysis.

Can a channel have a high CPA but still deliver a low CAC?

Yes. In some CPA vs CAC cases, high-CPA channels may produce fewer but more high-intent leads that convert easily into paying customers. The result is a low CAC, making the channel profitable despite a higher CPA.

How do CPA and CAC impact budgeting and forecasting?

CPA helps determine short-term campaign spend, while CAC influences long-term revenue forecasting and resource allocation. Brands compare CPA vs CAC to understand how much to invest in marketing, how aggressively to scale, and where budgets will generate the best return.