Have you ever started a campaign with positive results only to see those conversions disappear because of unexpected conflicts or payments that were reversed? That is the quiet damage that chargebacks can cause to performance marketing.

Chargebacks have the potential to damage trust and income flow in a sector where each click, lead, or transaction is tracked and paid for. They have an impact on your revenue as well as indicating more serious problems like fraudulent transactions or low-quality traffic.

Businesses can get greater visibility and control by identifying these trends early with the use of performance marketing software. However, you need to understand how chargebacks function if you want to prevent them.

What is a Chargeback?

Reversing a payment made by a consumer with a credit or debit card is known as a chargeback. Usually, the issuing bank steps in to repay the money when a consumer rejects a transaction.

A chargeback is required by the cardholder’s bank, as opposed to a standard refund that a company easily provides. Unauthorized transactions, billing mistakes, or discontent with a good or service are frequently the causes of it.

Chargebacks in performance marketing typically happen when a lead or sale is marked as invalid, either by the advertiser or the customer. This may result in additional operational work, lost revenue, and strained relationships with partners. Understanding it is the first step in reducing their impact and safeguarding campaign performance.

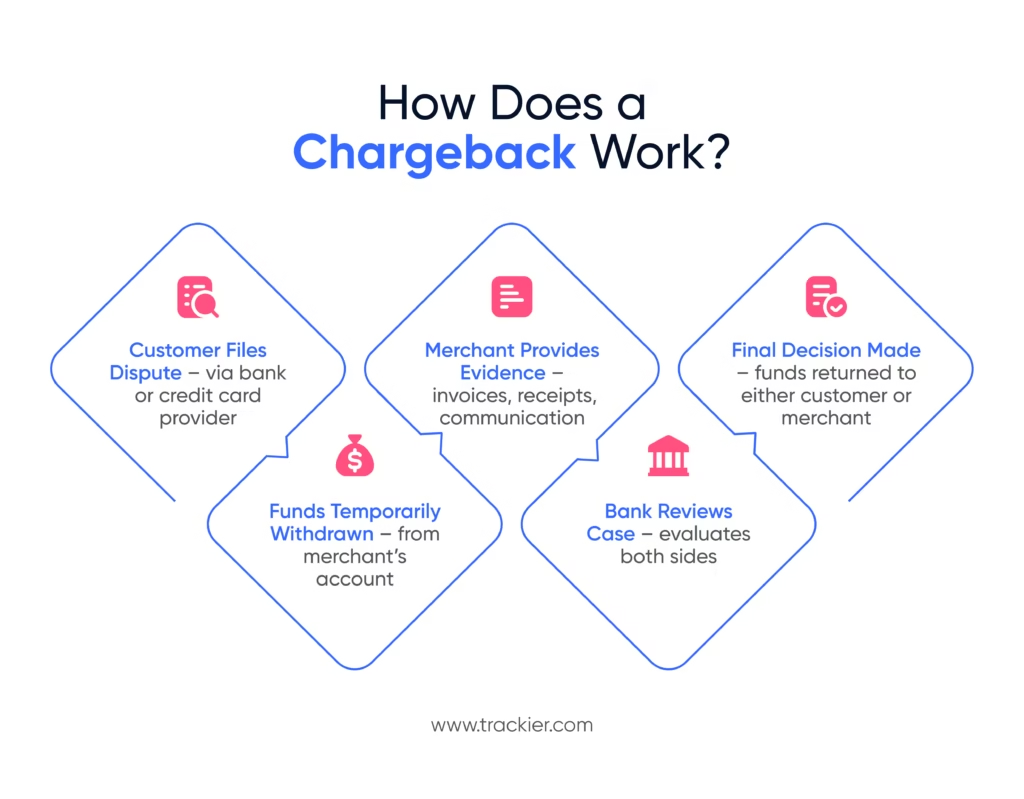

How Does a Chargeback Work?

When a consumer contacts their bank to dispute a charge on their account, the chargeback procedure starts. This could be the result of an unacknowledged transaction, fraud, or dissatisfaction with a good or service.

The bank temporarily takes the money out of the merchant’s account while it looks into the complaint. The merchant is informed and allowed to challenge the charge with documentation, such as transaction records, customer correspondence, or confirmation of delivery.

The bank considers both viewpoints before concluding. The chargeback remains valid, and the payment is permanently refunded if the bank decides in the customer’s favor. It can be rejected and the money can be repaid if the merchant’s proof is adequate.

This procedure often damages partner relationships and affiliate rewards in performance marketing, particularly when disagreements arise due to fraudulent strategies or low-quality traffic.

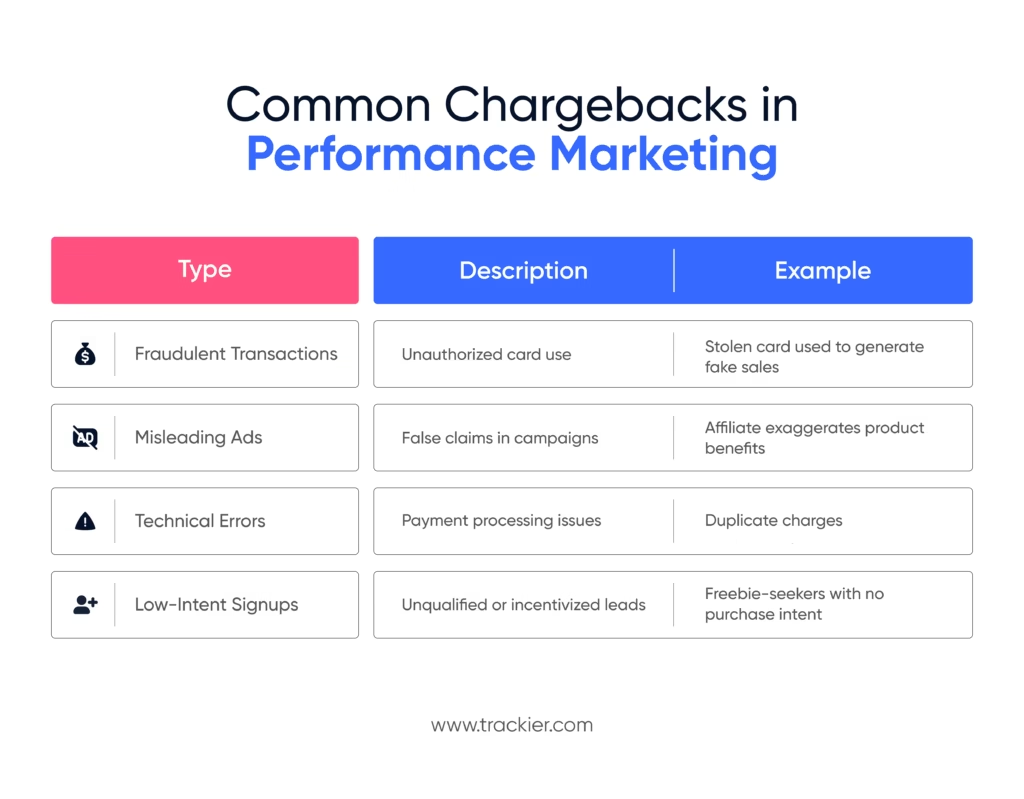

Types of Chargebacks in Performance Marketing

In performance marketing, chargebacks can come from a number of sources, and each kind poses different risks to affiliate partners and businesses. The most common are as follows:

1. Transactional Chargebacks

These happen when a client argues that they did not approve the purchase. This frequently indicates fraudulent activity or card details that have been taken.

2. Chargebacks Associated with Quality or Service

If a customer feels that an advertisement or landing site misled them, or if the goods or service did not live up to their expectations, they have the right to dispute charges. This can happen in affiliate marketing when affiliates make exaggerated or inaccurate claims.

3. Technical Chargebacks

These result from processing problems, incorrect numbers, or duplicate charges. Disagreements may arise from even a small error in the payment mechanism.

4. Incentivized or Fake Leads

To increase commissions, some affiliates use incentive traffic or fake signups. Advertisers frequently reject these leads after identifying them and request a refund for sums already paid.

Businesses should improve marketing controls and minimize unintended losses by being aware of these types.

What is Chargeback Fraud?

Chargeback fraud happens when a client reverses a valid payment by submitting a false dispute. “Friendly fraud” is another term for this, yet it’s not friendly at all. Even after receiving the product or service, the customer continues to insist that they never made the purchase or that they never received what was promised.

It can also happen in performance marketing when affiliates create fake conversions or signups using card information that has been stolen. This not only leads to lost revenue but also destroys trust between advertisers and affiliate partners.

Fraudulent chargebacks are more difficult to predict and manage than ordinary disagreements. They need a transparent transaction trail and solid proof. If not handled appropriately, they might result in significant chargeback ratios and payment processor fines.

What is a Chargeback Fee?

Merchants are required to pay a fee each time a chargeback is made against them, regardless of the outcome of the dispute. The payment processor charges this fee to cover the administrative expenses associated with managing the reversal procedure.

The cost of each varies based on the provider. However, it can typically range between 15 USD and 100 USD. In some circumstances, too many chargebacks can result in increased transaction costs or possibly the suspension of the merchant’s account.

Chargeback costs represent more than just a monetary loss for performance marketers. They point to more serious problems like affiliate abuse, ambiguous terms, or traffic fraud. Maintaining a low rate is important for both partner relationships and successful business operations.

Why Do Chargebacks Happen in Affiliate & Performance Marketing?

In affiliate and performance marketing, chargebacks typically happen when there is dishonest behavior or when the quality or intent of the traffic does not meet client expectations. Here are a few common reasons:

1. Fraudulent Traffic

To increase conversions, some affiliates may use bots, card data that has been stolen, or fake client information. Once the advertiser or payment processor discovers them, these frequently lead to chargebacks.

2. Misleading Ads or Offers

If an affiliate promotes an offer with false information, the customer may feel misled after purchase and file a chargeback.

3. Poor Client Experience

Customers may dispute payments rather than ask for a refund if there are hidden fees, unclear terms, or slow delivery.

4. Duplicate or Unauthorized Transactions

Customers frequently dispute repeated charges through their bank due to tracking or payment processing errors.

5. Signups with Low Intent

Unintentional or incentive-driven signups frequently result in refunds and dissatisfaction, which can then escalate to reimbursement.

How to File a Chargeback as a Customer

Customers can file a chargeback with their bank that issued their card. This is how it typically operates:

1. Contact the Bank

The client discusses the problem with the transaction with their bank or credit card company.

2. Submit Details

They give information about the transaction, including the date, amount, and the cause of the disagreement (e.g., non-delivery, unauthorized use, or false charges).

3. Bank Investigates

The bank initiates an investigation and temporarily removes the merchant’s funds. The merchant is then requested to provide proof in response.

4. Final Decision

The bank either reverses the transaction or closes the case in favor of the merchant based on the facts presented by both sides.

Although the procedure is intended to safeguard consumers, improper use can result in losses for companies, particularly in affiliate-driven marketing.

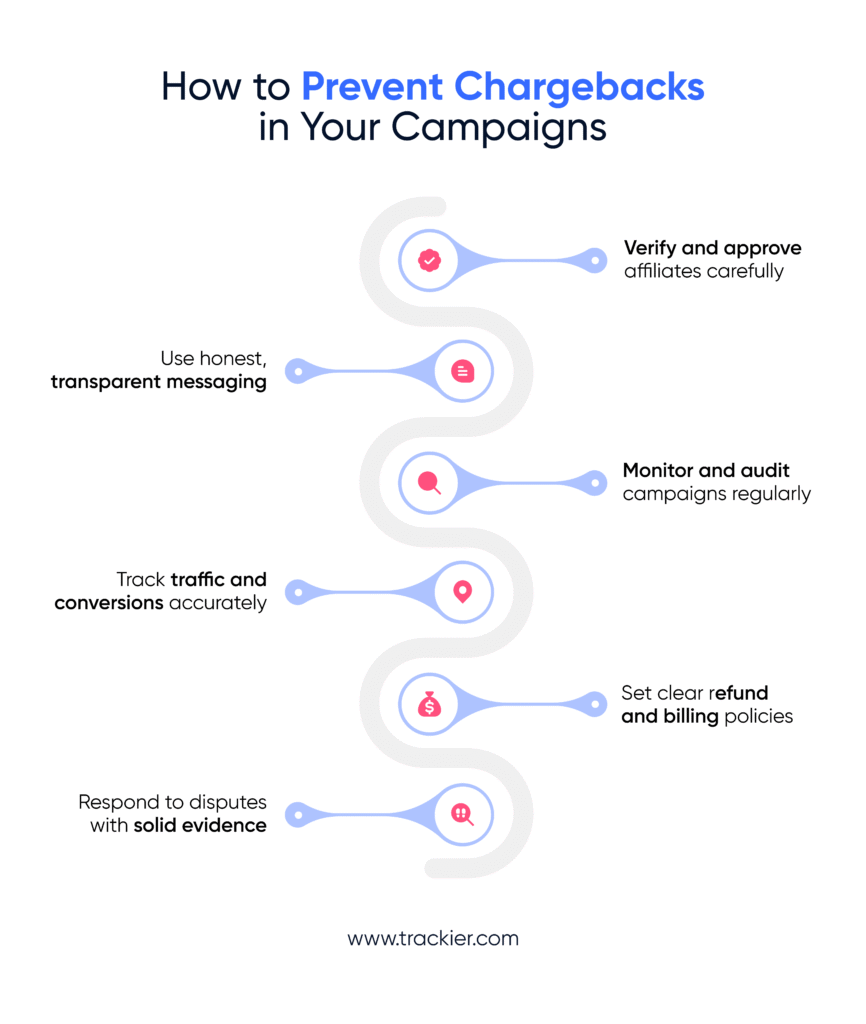

How to Prevent Chargebacks in Performance Marketing

Preventing chargebacks requires a proactive approach at all stages of your performance marketing efforts. Here are a few successful tactics:

1. Work with Authentic Affiliates

Only collaborate with affiliates who maintain transparent, moral standards. Before granting them access to offers, thoroughly verify them.

2. Make Use of Honest and Clear Messaging

Ensure that ad copy, landing pages, and product descriptions are accurate. Disputes frequently result from misleading content.

3. Accurately Monitor Conversions

To keep an eye on clicks, conversions, and traffic sources, use trustworthy monitoring tools. Early detection of odd trends can help cut down on fraudulent transactions or signups.

4. Clearly Define the Terms and Conditions

Be open and honest about service standards, return processes, and prices. This clears up misunderstandings and lowers the possibility of chargebacks for unfulfilled expectations.

5. Track and Audit Campaigns Frequently

Regularly review campaign results and affiliate behavior. Keep an eye out for warning indicators such as high refund rates, low retention, or increases in traffic.

6. Resolve Disputes Quickly

To preserve your revenue in the event of a compensation, provide strong proof, such as an order confirmation, correspondence with the consumer, or proof of delivery.

Conclusion

Chargebacks are an indication that something in your campaign flow requires adjustment. It affects revenue and reputation, regardless of the cause, fraud, incorrect messaging, or low-quality traffic.

It’s important for companies using performance marketing initiatives to keep up with chargeback trends. You can keep your campaigns clean and identify problems early with the aid of tools like Trackier that provide affiliate administration, real-time tracking, and fraud detection.

Preventing chargebacks is more than just securing revenue. The goal is to create a system that is fair, open, and long-lasting for everyone involved.

FAQs

1. What does chargeback mean?

A chargeback is a payment reversal that a client initiates via their card issuer or bank. It happens when a consumer disputes a charge, frequently as a result of fraud, incorrect invoicing, or dissatisfaction. After looking into the claim, the bank could take money out of the merchant’s account.

2. Is a chargeback a refund?

A refund is not the same as a chargeback. While it is enforced by the bank following a consumer disagreement, refunds are given out directly by the merchant. Chargebacks can result in extra costs and damage a company’s finances and reputation.

3. Can businesses fight a chargeback?

Yes, companies may file a chargeback by providing solid proof, such as communication logs, delivery confirmations, or transaction records. After reviewing this data, the bank determines whether to reverse it or leave it in place. The likelihood of winning is increased when you respond promptly.

4. How long does a chargeback take?

The duration of the procedure can range from a few weeks to more than a month. The payment network, the banks involved, and the speed at which the merchant and consumer provide the necessary data all affect the timeline. Quick responses help to speed up resolution.