The fintech market is growing faster than ever, and things are changing how financial services are catering to users. The main challenges for the new FinTech businesses are that they need to compete with the traditional players while ensuring they meet the needs of today’s customers, especially Gen Z.

To acquire new customers, the strategy must be different for lead generation that stands out from the competition.

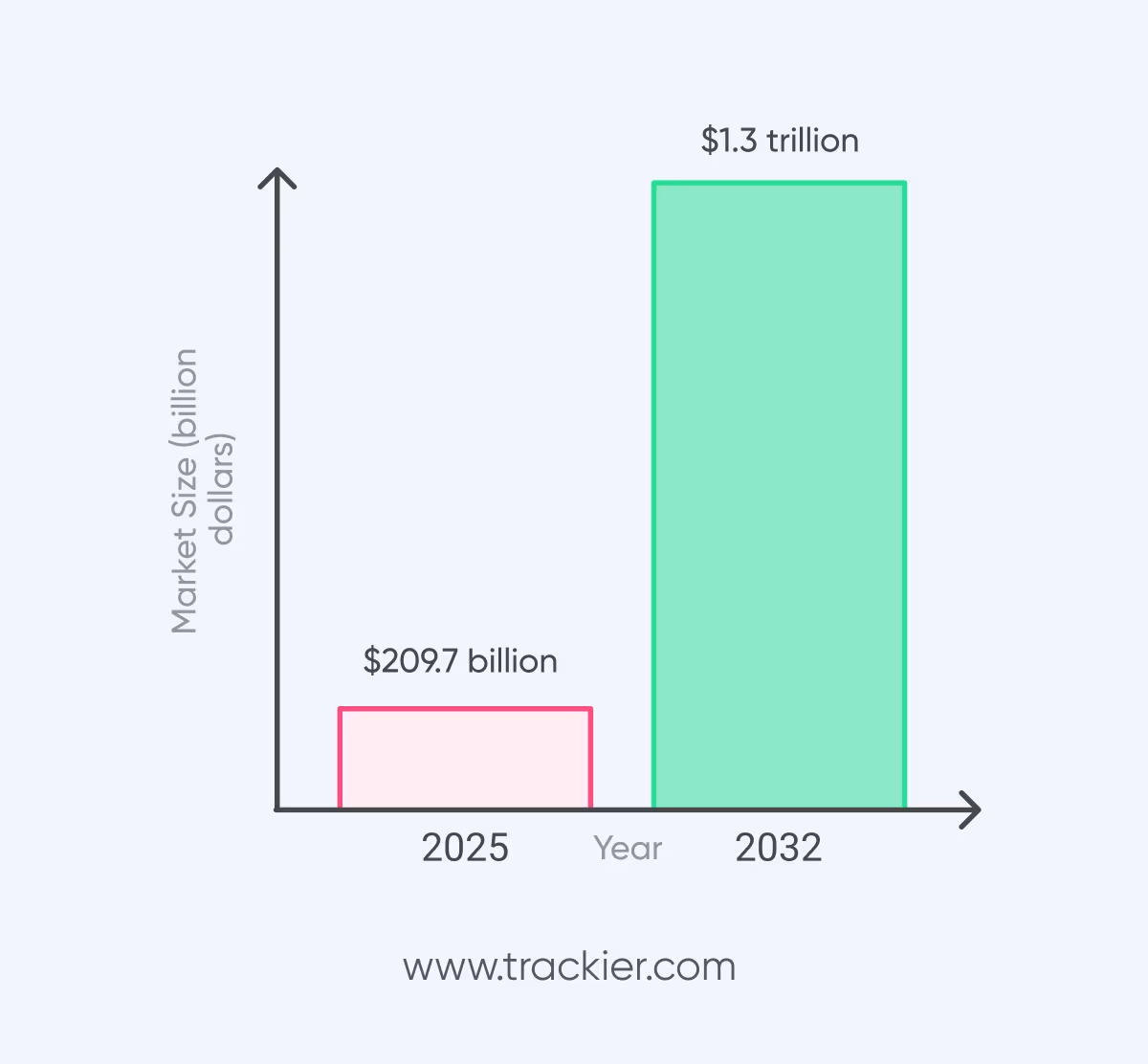

If we talk about the numbers, the global fintech industry is expected to grow to more than $209.7 billion by 2025 and potentially reach $1.32 trillion by 2032. This stat shows the massive opportunities for new FinTech businesses. However, this is a very competitive market.

Performance marketing gives Fintech brands a clear edge. Since it’s driven by results like clicks, leads, and conversions, it offers a data-backed way to grow users and optimize spending. In fact, financial services marketing spend has jumped by over 45% in the past three years, showing how much the industry is betting on performance to scale fast.

But success in 2025 doesn’t come only from performance marketing. Fintech marketers also need to:

- Handle stricter rules around data, ads, and following the law.

- Earn and maintain customer trust, especially while handling sensitive data security in fintech.

To win in this competitive market, FinTechs must balance three things: measurable growth, regulatory compliance, and consumer trust.

This comprehensive report is built to help you do just that. We’ll break down:

- The top fintech marketing trends for 2025.

- Regulatory challenges and how to handle them.

- Trust-building strategies that drive loyalty.

- Performance marketing tactics that deliver ROI.

- The role of tools and tech like Trackier for scaling campaigns efficiently.

Section 1: The Fintech Performance Marketing Outlook for 2025

The fintech market is growing fast, powered by smart tech, targeted strategies, and higher consumer expectations.

1. Market Momentum: Growth, Spend, & Investment

The fintech industry is growing fast. In 2025, it’s expected to be worth over $209.7 billion and might reach $1.3 trillion by 2032. What’s driving this growth?

- Most of the users want financial services on digital platforms.

- Payments, lending, and wealth tech are the industries that are evolving fast.

While funding dipped after the 2021 peak due to various macroeconomic changes, because of low interest rates, a booming tech sector, etc. However, as of 2025, it is stabilizing now. However, they are setting more realistic expectations:

- Less Hype

- More Focused on ROI

- Performance

What’s interesting? Even though funding is staying steady, spending on ads is still rising.

- Fintech marketing budgets jumped 45% over the last 3 years.

- 73% of financial services marketing firms plan to spend more on digital marketing in 2025.

This stat now ensures that performance marketing is not just a tactic anymore; it becomes a growth strategy. Every investor wants real numbers, including:

- Acquisition Cost

- LTV (Loan to Value)

- User Retention

2. Tech That’s Changing the FinTech Industry

As of 2025, four tech spaces are changing the FinTech industry, including AI (trending), tech combined with finance, payment methods, open banking, and open finance. Let’s break it down.

A. AI for Personalized Recommendation

AI is becoming core to how fintechs market and serve users. From personalized savings tips to predictive lending tools, AI makes financial experiences feel personal and useful.

- Chatbots, robo-advisors, and real-time offers based on behavior are now must-haves.

- AI spending in financial services is set to reach $97B by 2027.

B. Embedded Finance

Think of financial services built into non-financial platforms, like loans inside e-commerce apps or websites, or insurance within travel apps.

- Embedded finance is expected to hit $138B+ by 2026.

- This combination offers seamless UX and opens up new revenue streams.

C. Emerging Payments

Fintech startups are changing the way we pay. For example:

- P2P (Person to Person) lending payments are rising fast.

- Stablecoins like USDT, real-time payment updates, and digital wallets like PhonePe, Paytm, PayPal, and Apple Pay are gaining traction.

- Marketing is primarily for speed, trust, and user control.

D. Open Banking & Open Finance

APIs are unlocking data across banking, investing, insurance, and more, which allows FinTechs to create connected and smarter experiences. It also opens new possibilities for targeting and personalization.

All these innovations work best with AI layered on top—contextual, predictive, and data-driven marketing will define winning FinTechs in 2025.

3. Marketing Channels That Deliver Performance

Fintechs are mixing high-intent channels with community-driven ones. The goal? Getting results while building trust. It includes:

- Paid Search (PPC/SEM): Best for attracting users actively looking for solutions. For instance, “compare loan rates” or “low interest rate loans”.

- Social Ads: Use LinkedIn for B2B and Facebook/Instagram for B2C. Target users based on behavior, not just job titles.

- Affiliate & Influencer Marketing: Collaborate with finance creators, podcasters, and bloggers. Micro-influencers often bring high engagement and trust. Choose performance models like CPA or revenue share.

- Content Marketing & SEO: In finance, users need clarity. Provide them educational blogs, videos, calculators, and guides to build authority and improve overall SEO.

- Email Marketing: This is still powerful in 2025. 92% of adults who go online use email, and 61% check it daily.

- Communities: Online social media channels like Discord, Reddit, and private groups help with engagement, support, and feedback loops.

The shift is clear: Educate first, sell second. The best-performing fintechs aren’t just running ads, they’re building ecosystems.

4. What do Today’s Fintech Users Expect?

Customers, especially Gen Z, expect smart, simple, and secure financial experiences. Provide them:

- Seamless UX: Mobile-first is mandatory. Platforms must work flawlessly across devices.

- Personalized Journeys: Offers, dashboards, and messages should feel personalized.

- Transparency & Trust: Clear fees, data usage, and compliant policies (GDPR, CCPA) build long-term loyalty.

- Proactive Support: AI-powered help and predictive support matter more than waiting on hold.

Big tech companies are raising the standards, and FinTechs must offer the same level of convenience, personalization, and quick service to stay in the domain.

Section 2: Understanding Compliance in Fintech

In fintech, compliance isn’t just a legal box to check. It’s key to building trust, growing your brand, and staying in business long-term.

Marketing teams, especially in performance-focused companies, need to understand how regulations affect things like campaign messaging and how they collect and use data.

Why Compliance Matters in Fintech Marketing?

Fintech companies deal with strict rules, everything from anti-money laundering (AML) and know your customer (KYC) checks to how user data is handled and how products are promoted.

For marketers, this means:

- You must be careful about how you promote financial products.

- All customer data collected through campaigns must be handled securely.

- Misleading offers or unclear terms can lead to serious penalties.

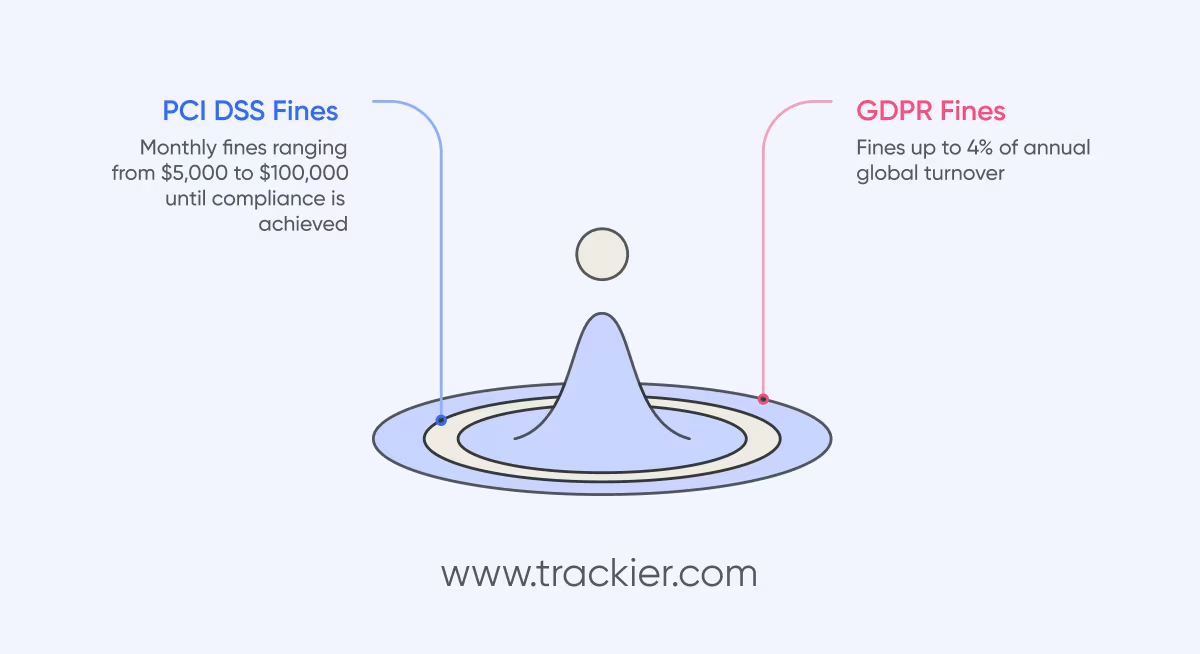

Non-compliance can lead to hefty financial penalties. For example, failing to meet Payment Card Industry Data Security Standard (PCI DSS) requirements can result in fines from $5,000 to $100,000 per month until the issue is fixed. Also, GDPR violations can cost up to 4% of annual global turnover.

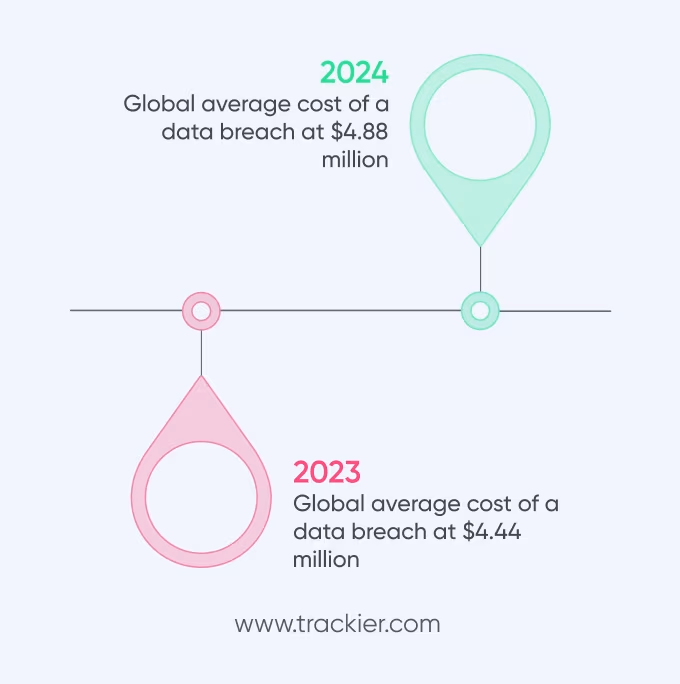

Beyond fines, non-compliance increases the risk of data breaches, which are getting more expensive. The global average cost of a data breach hit $4.88 million in 2024, a 10% jump from the previous year.

Regulations aren’t just there to avoid fines. They help build trust, unlock new markets, and create opportunities for partnerships. Marketing and compliance need to work closely together. Otherwise, campaigns could end up doing more harm than good.

Global Compliance: What Marketers Should Know?

If you’re marketing fintech products across regions, you’re dealing with multiple sets of rules. Here’s what you need to keep in mind:

- US: A mix of federal and state-level regulators (like the CFPB, SEC, and FTC). Rules are strict and differ by state.

- EU: The GDPR leads the way, with rules aimed at protecting consumer rights and data privacy.

- UK: Post-Brexit, the UK has its own playbook but encourages innovation through programs like regulatory sandboxes.

- Asia: Markets like Singapore and China have their own specific frameworks.

Despite regional differences, most regulators focus on:

- Preventing fraud and financial crime (AML/KYC)/

- Protecting consumer data.

- Ensuring transparency in advertising.

- Making sure FinTechs can operate securely and reliably.

Data Privacy: What GDPR and CCPA Mean for Marketing?

Data privacy laws like the GDPR (EU) and CCPA/CPRA (California) have redefined how marketers collect, store, and use customer data. Here’s how it affects your campaigns:

A. Consent is Necessary

You must get clear, informed permission before using users’ data, especially for email marketing, retargeting, or placing cookies.

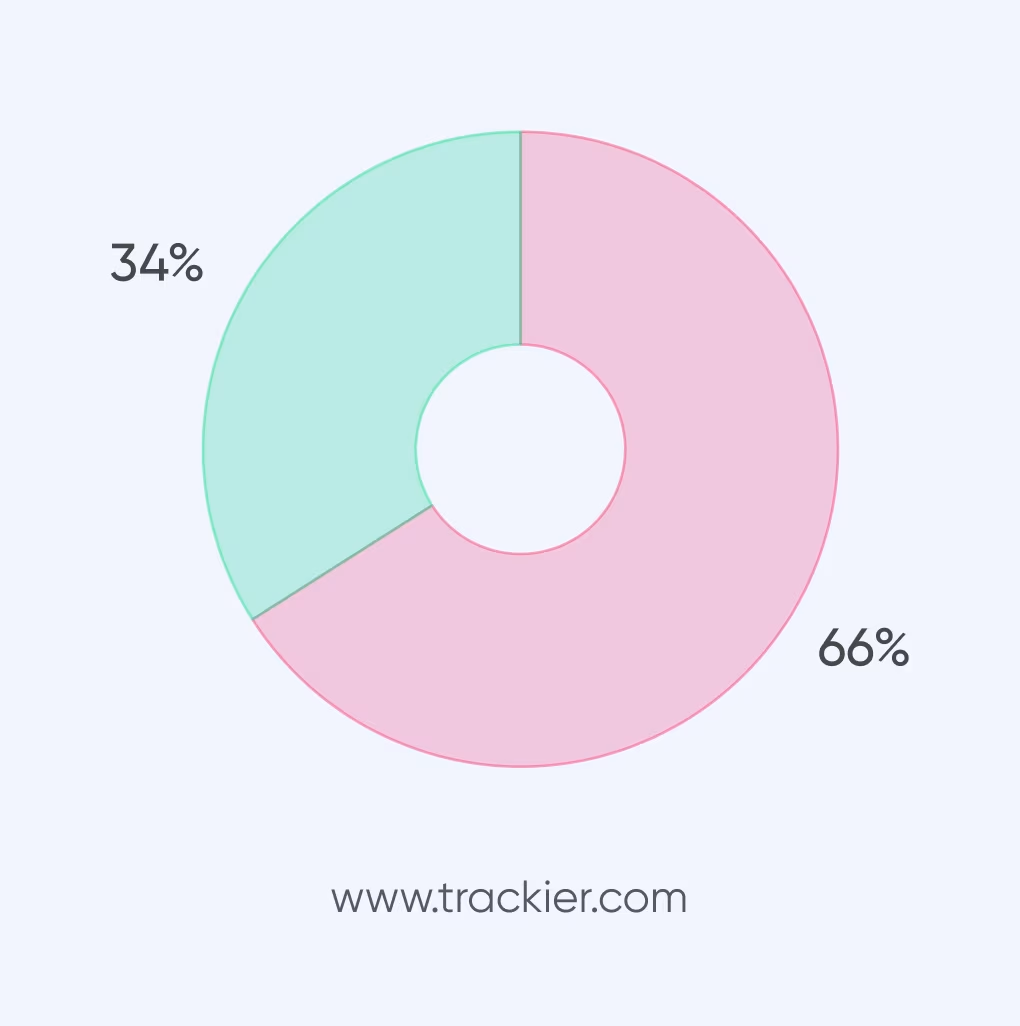

66% of consumers have stated they would stop supporting a company if their data were breached or shared without permission.

B. Be Transparent

Let users know exactly what data you’re collecting and why. Only 32% of consumers say they trust brands to use their data responsibly. That trust grows when you communicate clearly and give people a real choice.

C. Respect User Rights

Under GDPR and CCPA, people have the right to see their data, fix any mistakes, or ask companies to stop using it. And many are doing just that. If your system can’t manage these requests properly, your business could be in trouble.

D. Collect Only What You Need

GDPR specifically limits data collection to what’s necessary. Over-collection has consequences: since 2018, GDPR fines have exceeded €4 billion, many of them due to unnecessary or excessive data gathering.

E. Stay secure

Use encryption and secure systems to protect customer data. The 2023 IBM Data Breach Report found that 45% of marketing-related breaches involved personal data that wasn’t properly secured. If you’re collecting it, you’re responsible for protecting it.

Marketing & Advertising Rules You Can’t Ignore

Regulators care deeply about how financial products are promoted. Across markets, your messaging must be:

- Clear

- Accurate

- Not misleading

In the UK, the Financial Conduct Authority (FCA) is especially active when it comes to policing financial promotions. In 2024 alone, the FCA intervened in nearly 20,000 promotions—almost double the number from the previous year.

High-risk products like crypto are under heavy scrutiny, and the FCA has begun targeting influencers promoting unregulated investments. Twenty individuals were interviewed under caution in 2024 for such offenses.

The FCA also cracked down on Claims Management Companies (CMCs), intervening in over 9,000 ads that were largely aimed at vulnerable consumers.

In the US, regulators like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) enforce strict rules to prevent deceptive advertising. In 2023, the CFPB filed 29 enforcement actions and recovered more than $3 billion for consumers.

Key tips:

- Disclose all important terms clearly (rates, risks, conditions).

- If using influencers or affiliates, ensure they follow the same rules.

- Social media content must meet the same compliance standards as your website or ads.

- Don’t assume you’re safe; regulators are watching, and enforcement is ramping up.

How Compliance Failures Can Impact Your Business?

Ignoring compliance comes with serious risks:

- Heavy Fines: Regulators can impose fines that can go up to millions. GDPR fines alone can go up to 4% of global revenue.

- Damaged Reputation: Once trust is broken, it’s tough to get back customers or partners.

- Operational Issues: You could face business restrictions or even get shut down temporarily.

- Legal Costs: You may have to spend big on lawyers, investigations, and fixes.

Marketing in fintech is crucial and risky. Compliance needs to be a key part of your planning from the start, not something you think about later.

It should be considered in your campaigns, messaging, partnerships, and even the tools you use. Many top companies are now using RegTech to handle this more effectively.

Section 3: Building and Maintaining Trust Through Performance Marketing

In fintech, trust isn’t just important, it’s everything. When people are sharing sensitive data or making financial decisions, they need to feel confident about who they’re dealing with.

And while performance marketing is often seen as a tool to drive conversions, it also plays a critical role in building and maintaining that trust.

A PYMNTS report from November 2024 highlights that 63% of U.S. consumers aged 18 to 34 are open to receiving financial services from non-financial brands.

Additionally, a survey by YouGov in May 2022 found that 44% of consumers in the Asia-Pacific region trust digital-only banks, compared to 73% who trust traditional banks.

User-generated content (UGC) is another major trust builder. 92% of people look for reviews before making a decision. Ads that feature UGC have been shown to boost click-through rates by up to 90%.

Why Trust Matters in Fintech?

Finance is personal. Many users, especially first-timers or those exploring newer fintech products, have doubts. And with privacy concerns around data still high, most users won’t engage unless they feel secure. This is why digital transformation in banking is crucial, it enhances security and delivers seamless, personalized experiences that build trust and confidence among users.

If your performance marketing campaigns raise red flags like unclear messaging, too-good-to-be-true claims, or shady landing pages, you could lose that trust fast.

On the flip side, honest messaging, transparent offers, and secure user journeys build trust over time. Every campaign, ad, or affiliate review is a chance to either build confidence or break it.

Fintech marketers need to be especially careful: overpromising and underdelivering can seriously damage your brand and take a long time to recover from.

Trust-Building Tactics for Performance Marketers

To earn and keep user trust, your performance marketing strategy should be built around a few key principles:

- Be Clear and Transparent: Avoid confusing terms or hidden details. Be upfront about pricing, data use, product risks, and conditions. Use simple language and make sure everything users need to know is easy to find.

- Use Ethical Campaigns: Stay away from hype-driven messaging or “quick money” promises, especially in crypto or lending spaces. Focus on educating users and offering real value, not just chasing clicks.

- Talk About Data Security: Let users know how you keep their data safe. Highlight privacy protections, secure logins, and compliance with regulations like GDPR or CCPA. As threats evolve, consider implementing comprehensive security approaches like continuous threat exposure management to continuously assess and validate your security posture. Users trust platforms that care about security.

- Guide Your Partners: Whether you’re working with affiliates or influencers, make sure they follow your compliance guidelines and share your values. A single unethical partner can hurt your brand reputation.

- Show Real Proof: Share customer reviews, case studies, and real success stories. Build community through authentic conversations and user-generated content. Let your audience see the people behind your brand.

- Stay Consistent: Keep your tone, design, and messaging uniform across every touchpoint—ads, landing pages, emails, and partner content. Consistency builds a brand’s credibility.

Section 4: Key Performance Marketing Strategies for Long-Term Fintech Growth

Trust and compliance are essential for any FinTech business, but performance marketing is what truly drives long-term growth.

To stay competitive in 2025, fintech companies must focus not just on acquiring users but also on optimizing every stage of the customer journey—from acquisition to retention.

Bain & Company reports that increasing customer retention by 5% can lead to profit increases ranging from 25% to 95%. That’s where tools like AI and predictive analytics become critical, enabling personalized experiences that keep users engaged and loyal.

Scalable Customer Acquisition

For most fintech companies, user acquisition is a top priority. Performance marketing offers scalable and trackable methods to get in front of the right users.

- Target the Right Audience: Use intent-driven channels like Paid Search, interest-based targeting on Social Ads, or niche outreach through Affiliate and Influencer Marketing. Define your segments—millennials for investing apps and SMBs for lending platforms, and tailor your messaging accordingly.

- Diversify Your Channels: Don’t rely on just one source. Combine PPC, social ads, affiliates, SEO, and content marketing. This not only spreads your brand but also allows you to reach users across different platforms and touchpoints. A well-integrated multi-channel approach improves efficiency and performance.

- Scale What Works: Performance marketing lets you double down on campaigns that perform. Adjust budgets in real time based on results. Explore affiliate programs, brand partnerships, and retail media networks to unlock scalable acquisition.

How to Increase Your Conversion Rate?

Getting just traffic to your website is not the last step. The main work starts from there to convert that traffic into real paying customers.

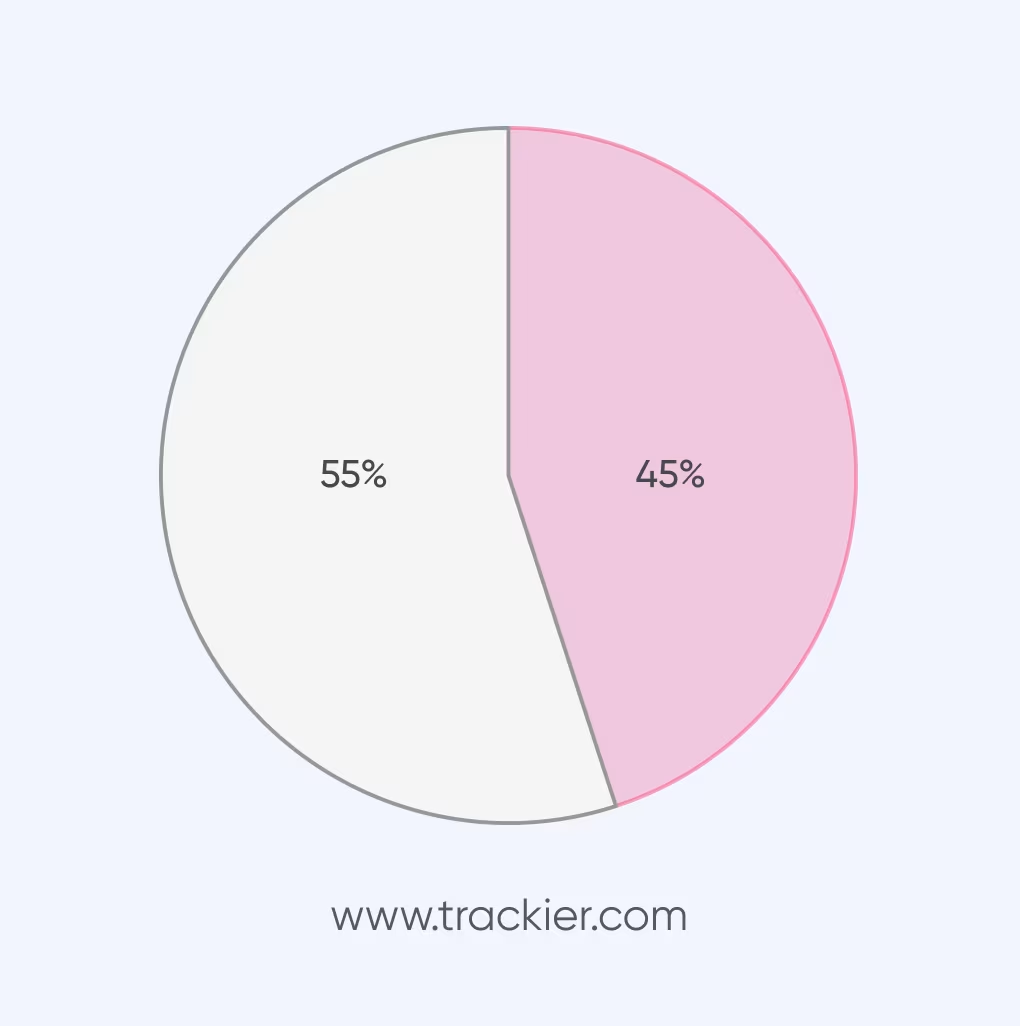

However, only 2.35% of website visitors convert into real customers, and the best one has a ratio of 11%. Fintech businesses can improve their conversion rate by optimizing it. Here are some of the key strategies:

- Optimize Landing Pages: The landing page is the first thing that the user interacts with. So, optimize it the best way possible to get the most out of the interaction. Some ways are testing different headlines, CTAs, copies, and form fields (like decreasing the number of form fields). As per Unbounce, reducing form fields from 11 to 3 could boost conversion rate by 120%.

- Run A/B Tests End-to-End: Test everything, whether it is ad creatives, copies, targeting, commission models, or even the offer format. Different versions can be helpful for different sets of audiences.

- Improve the User Experience: Most users leave a site when the user experience is poor, especially mobile users, with a 90% bounce rate if pages load slowly. Simplify the journey, prioritize mobile UX, and optimize performance, as only 22% of businesses are satisfied with their conversion rates.

How to Increase the Customer Lifetime Value?

Acquisition is just the start. Real growth comes from turning users into loyal customers.

- Focus on Retention: Use performance marketing software to keep users engaged—targeted email flows, in-app offers, or loyalty programs that reward repeat usage. Build communities to drive stickiness and reduce churn.

- Personalize Everything: Leverage data to offer personalized products or next-best actions like investment suggestions, top-up loan offers, or savings tips. The more relevant your messaging, the more valuable the user becomes over time.

Smarter Attribution for Smarter Spend

To grow efficiently, you need to know what’s working.

- Go Beyond Last-Click: Today’s user journey includes multiple touchpoints. Relying on last-click attribution doesn’t tell the full story. Fintechs need better attribution models to understand which channels drive value.

- Use Multi-Touch Attribution: Adopt attribution models that show how each channel contributes, from awareness to conversion. Whether it’s affiliates, content, social, or search—know what’s pulling the weight and optimize spending accordingly.

- Invest in the Right Tools: Performance marketing platforms like Trackier help track users across devices, channels, and touchpoints. With real-time reporting, you can make faster decisions and improve ROI across the funnel.

Section 5: How Technology Drives Performance Marketing in FinTech?

Fintech brands face a unique set of challenges—strict regulations, the need for customer trust, complex products, and high exposure to fraud. In the 2025 report, nearly a third of financial organizations reported direct fraud losses exceeding $1 million.

Platforms like PayPal have reported discovering 4.5 million illegitimate accounts in a single quarter. It’s clear that fraud prevention and trust-building aren’t optional—they’re foundational.

At the same time, staying compliant is no small task. 93% of FinTech companies say they struggle with meeting regulations, and nearly a quarter rank the cost of compliance as their biggest challenge.

To grow efficiently, FinTechs can’t rely on basic marketing tools. They need solutions built for this level of complexity.

That’s where performance marketing platforms like Trackier make a difference. It helps brands stay compliant, protect against fraud, and run campaigns that deliver real results. With the global fintech market expected to reach $190 billion by 2026, technology isn’t just helping performance marketing, it’s driving it forward.

Why Do Fintech Brands Need Specialized Platforms?

Here’s why a fintech can’t settle for generic tools:

- Handling Complexity: Fintechs run campaigns across multiple channels like affiliates, influencers, and paid media, and deal with strict data policies. They need platforms that centralize tracking, reporting, and partner management, all in one place.

- Making Data-Driven Decisions: Campaigns succeed when every click and conversion is tracked in real time. Fintechs rely on insights like CAC, LTV, and ROAS to optimize spending and show ROI. Without accurate data, that’s impossible.

- Improving Efficiency with Automation: Manual work slows growth. Modern platforms automate repetitive tasks like conversion tracking, partner payouts, fraud checks, and reporting, so teams can focus on scaling results.

Essential Features for Fintech Performance Marketing

To succeed, FinTechs need platforms with the right features:

- Accurate Tracking & Attribution: Fintechs must track every user touchpoint across web, mobile, and partner channels. Real-time attribution helps identify what’s working so that budgets go to high-performing sources.

- Granular Analytics: Dashboards should show performance at every level—by campaign, partner, and channel. Real-time reporting on CAC, ROAS, LTV, and conversion rates helps teams act fast and prove results to stakeholders.

- Fraud Prevention Tools: Fintech is a hot target for fraud, like fake leads or bot clicks. Platforms must have strong fraud protection using AI and custom rules to catch suspicious traffic before it drains budgets.

- Partner Management at Scale: Whether it’s 10 or 1,000 affiliates, fintechs need tools for onboarding, tracking, communicating, and optimizing partner performance—all from a single dashboard.

- Automated Payouts: Paying partners on time keeps them motivated. Platforms must support flexible commission models like tiered CPA or recurring commissions and automate secure payments.

- Compliance Support: From GDPR to financial promotion rules, fintechs must follow strict laws. Platforms should support privacy flags, help manage disclosures, and track compliance-related tasks to reduce risk.

Trackier: Built for Fintech Performance Marketing

Trackier is purpose-built for sectors like fintech, where accuracy, trust, and compliance are key. Here’s how we help:

- Compliance Made Simple: Trackier supports GDPR/CCPA compliance with tools like consent flags, secure data workflows, and features that help monitor partner promotions, so you stay aligned with industry rules.

- Trust Through Transparency: Trackier offers accurate tracking and real-time dashboards, helping fintechs and partners see the same numbers. That transparency builds trust and avoids reporting issues that harm relationships.

- Tools for Growth: Trackier helps you scale smartly with data-rich insights, real-time KPI tracking, and attribution modeling. Whether you’re running influencer, affiliate, or paid campaigns, the platform gives you the tools to optimize every channel.

- Strong Anti-Fraud Suite: We help Fintechs block invalid traffic in real time using AI and custom rules. From click spamming to SDK spoofing, Trackier protects your budget and data accuracy.

- Advanced Reporting: Our platform gives you live dashboards that track the KPIs that matter, such as CAC, LTV, ROAS, and more, which makes it easier to optimize performance and report ROI to investors or leadership.

- Smooth Partner Payouts: Trackier supports custom payout models suited for fintech (e.g., tiered commissions based on approvals or subscriptions) and ensures timely, automated payments to your partners.

Section 6: Future Outlook & Conclusion

As the fintech industry moves toward 2025 and beyond, performance marketing, compliance, and consumer trust will continue to define success. For fintech marketers, staying ahead of current trends and preparing for what’s coming is essential to remain competitive.

Key Trends, Challenges, and Opportunities

This report highlights key factors driving the fintech performance marketing space in 2025. AI is no longer just a tool, it’s transforming marketing. It’s improving personalization, identifying fraud detection, and helping in innovations like combined finance.

At the same time, regulatory requirements are becoming stricter worldwide, especially around data privacy, fair advertising, and financial promotions. Earning and maintaining consumer trust is more important than ever, requiring transparency, ethical practices, and strong security at all stages.

Effective performance marketing must go beyond acquisition to include the full customer journey. This means using data and accurate attribution models to support long-term growth.

Looking ahead, some trends will change the industry. Financial services combined with Web 3.0 and the metaverse may create new ways to engage customers, though they may also bring new regulatory challenges.

AI will continue evolving, possibly automating more marketing tasks, while predictive models get even better. Regulations will keep evolving, with stricter rules for areas like BNPL (Buy Now Pay Later) and clearer regulations for open finance.

Strategic Recommendations for Fintech Marketers

To succeed in this changing sector, FinTech marketers should focus on the following actions:

- Prioritize Compliance: See compliance as a strategic asset, not a hurdle. Make sure data privacy, advertising rules, and anti-money laundering (AML) practices are part of product development, marketing campaigns, partner selection, and technology procurement from the start. Strong teamwork between marketing, legal, and product teams will ensure alignment.

- Build Trust & Transparency: Make trust a key part of your strategy. Use ethical marketing practices, ensure all messaging is clear and honest, and actively communicate your security measures. Trust is built through consistent action across all customer touchpoints.

- Use Data & AI Effectively: Leverage data and AI to deliver personalized experiences, optimize campaigns, and boost efficiency. But ensure you’re using data ethically, being transparent with consumers, and complying with privacy regulations. Always have a human review to prevent bias or unintended consequences.

- Focus on the Full Funnel: Don’t just focus on acquiring new customers. Optimize the entire customer journey. Invest in improving conversion rates, enhancing customer retention, and increasing lifetime value. Use advanced attribution models to understand how your marketing efforts are performing across the funnel.

- Invest in the Right Technology: A generic marketing tool is not the best for fintech platforms. And the main reason is that fintech apps or platforms are not the generic tools that everyone will gonna use. So, choose a performance marketing tool that is solely built for solving fintech needs, just like Trackier. It offers accurate tracking, fraud prevention (a key feature for fintechs), partner management (whether 1 or more than 1,00,000), and compliance support.

Conclusion

The fintech marketing industry in 2025 presents both opportunities and challenges. Success will require balancing growth, compliance, and trust. These three pillars are interconnected, and failure in one area can impact the others.

Technology plays a crucial role in achieving this balance. Performance marketing platforms like Trackier provide the infrastructure needed to manage campaigns, prevent fraud, streamline operations, and support compliance efforts.

By using the right strategies, focusing on compliance, building trust, and choosing the right technology, Fintech companies can handle the challenges of the 2025 market and position themselves for long-term growth and success.