Affiliate marketing cost is one of the most common questions marketers ask in 2025.

With customer acquisition costs rising and consumers paying less attention to traditional ads, more brands are moving toward performance-based channels. Affiliate marketing stands out because you only pay when results are delivered.

However, building an affiliate program involves more than just setting a commission rate. There are technology fees, management costs, and payout structures that vary across industries. If you are planning to launch or scale a program this year, you need clarity on what to budget for and what kind of returns you can expect.

With tools like Trackier’s automated invoicing you can further simplify and automate your affiliate payouts.

This blog will help you map income against expenses and make informed decisions for growth.

How much does affiliate marketing cost in 2025?

Let’s peel back the layers of affiliate marketing cost. There are three primary drivers: commission payouts, platform or network fees, and program management. Each one requires careful planning to avoid surprises and control your affiliate marketing budget properly.

Commission payouts

Most affiliate programs center around paying partners based on actions, they typically get a commission for each sale or lead they help generate. In 2025, standard rates sit between 5 to 30% of the sale amount, depending on the vertical. Retail, beauty, and fashion brands often pay on the higher side, while electronics, B2B, and high-end products lean lower due to tighter margins. Recent data confirms these benchmarks and shows that median affiliate commission rates remain in that range across industries.

Platform or tracking tool subscriptions

Affiliate programs need tracking and reporting. That means investing in software or network tools, even if you run a lean program. In 2025, small businesses typically pay 50 to 500 USD per month for basic tracking tools. For better features, like fraud detection, analytics, partner dashboards, and international payout support, expect to pay 300 to 700 USD per month.

Enterprises managing global or high-volume programs might spend 1,000 USD or more per month on comprehensive affiliate platforms.

Tools like Trackier report that investing in fraud control and multi-touch attribution tools is increasingly necessary in 2025 to maintain program performance and reliability.

Program management

You also have to weigh the cost of managing the program. An in-house affiliate manager in the U.S. commands about 55,000 to 80,000 USD annually, plus benefits and overhead. If you decide to outsource management to an affiliate marketing agency or OPM (outsourced program manager), monthly fees usually run from 2,000 to 10,000 USD depending on the scope, e.g. recruiting affiliates, setting up campaigns, creative, reporting, and optimization.

Choosing between in-house and outsourced hinges on your team’s bandwidth, the scale you expect to reach, and your control needs. For distributed teams, having the right remote worker app can make a big difference, ensuring seamless collaboration, task tracking, and real-time communication no matter where your managers or affiliates are located.

Putting it all together

Here’s a cumulative shot of what a monthly affiliate marketing cost might look like for three types of brands:

| Business Type | Commissions (variable) | Platform Fees | Management Cost | Total Estimate (Monthly) |

| Small business / startup | $1,000 – $3,000 (10–30%) | $50 – $150 | Part-time internal or DIY | ~$1,050 – 3,150 |

| Mid-size / SMB brand | $5,000 – $15,000 (15–25%) | $300 – $700 | Partial in-house or hybrid | ~$5,300–15,700 |

| Enterprise / global brand | $20,000 – $50,000+ | $1,000+ | Full-time team or agency | ~ $22,000 – 60,000+ |

What affiliate marketing budget should businesses plan for?

If you’re wondering what affiliate marketing budget you should plan for, the answer depends on your business size, goals, and margins. Let’s walk through realistic ranges and budget strategies you can adapt right now.

1. Starter (solo seller or small business)

For lean setups, your budget might be as low as 300 to 1,000 USD per month. This covers basic affiliate software and a small commission pool to attract partners. Many brands launch with a small, organic affiliate group, bloggers in their niche, customers who love their product, and micro-influencers. This way, affiliate marketing cost stays low while you test how it performs. As traction builds, you reinvest earnings back into payouts and tools.

2. Small to mid-size businesses

These businesses often allocate around 10 to 25% of their total marketing budget toward affiliate programs. If your monthly marketing spend is 20,000 USD, allocating 2,000 to 5,000 USD toward affiliate makes sense. That gives you room for higher-value commissions, some creative content production, and stronger platform features like multi-touch attribution or fraud detection.

While specific benchmarks vary, a recent affiliate growth study shows that many brands spend 15 to 20% of their digital marketing budget on affiliate marketing, seeing improved ROI compared to ads that require upfront payments.

3. Enterprise and high-growth brands

If your brand is handling thousands of affiliate partners and global markets, your affiliate budget needs to scale accordingly. Monthly spending in large enterprises can hit 10,000 to 50,000 USD or more, covering advanced tracking, dedicated affiliate teams, creative support, and high-tier partner incentives. The key benefit here is control. With a strong affiliate program, you replace uncertain media spend with performance-based cost, making marketing spend more flexible and tied to revenue.

How to approach your affiliate budget strategically

Assigning a number is just the first step.

What matters is how you track and allocate it:

Start with a percentage

Link your affiliate marketing cost to business goals. If your CAC goal allows for 20% of the budget on affiliates, stick to that ceiling until you have ROI data.

Use a tiered rollout

Begin with a trial period using a small group of affiliates and moderate commission. As conversions and ROI improve, layer in bonuses or jump to higher tiers. That keeps your affiliate marketing cost aligned with performance.

Monitor and adjust regularly

Check affiliate marketing income vs expenses on a month-by-month basis. If effective cost per acquisition is lower than paid media, reinvest in that channel. If not, hold or reduce spend.

Factor in production costs

Affiliate marketing cost often miss design or copy expenses. If you create banners, promo videos, or email content for affiliates, put those in your affiliate budget. Even small design costs like 500 USD per campaign can eat into your returns. If product reviews are part of your content mix or affiliate enablement, an AI product review generator can quickly produce authentic, platform-ready review copy based on your product details and tone.

Plan for seasonal changes

Sales and holidays bump up affiliate activity. Set aside extra budget in Q4 or around key launches. Many brands bring in double the normal affiliate budget during peak months to leverage heightened affiliate traffic.

Why budget clarity matters

When you treat affiliate marketing as a channel that can scale predictably, it changes how finance and leadership view it.

Instead of wondering about how much it costs, you present a model:

- Fixed costs: platform, tools, content

- Variable costs: affiliate payouts, bonuses, seasonal spikes

- ROI data: cost per acquisition, return on affiliate spend

That transparency makes affiliate marketing cost easier to justify than broad-reach ad buys that offer no guaranteed return on ad spend.

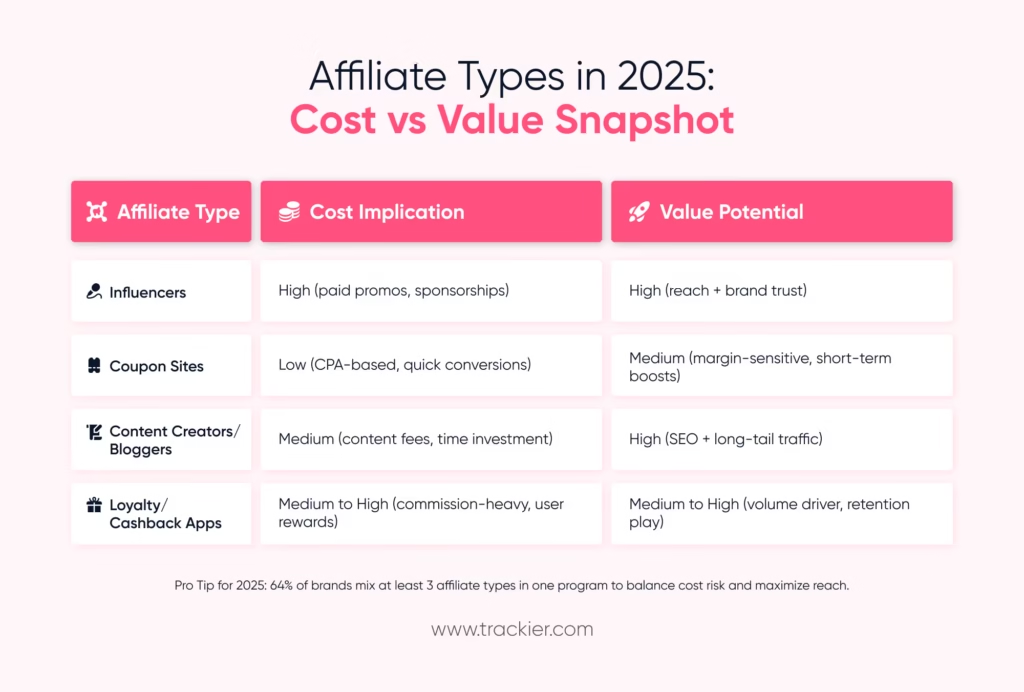

Affiliate types and cost implications

Not all affiliates cost the same, or deliver the same value. Your affiliate marketing cost and strategy should account for the differences.

Here’s how various affiliate types typically compare in cost and performance in 2025:

Influencer affiliates

These are individuals on platforms like Instagram, TikTok, or YouTube with engaged audiences. The cost often includes a fixed content fee plus commission. Expenses may range from $200 to $2,500 per post, plus 5–20% commission on sales. The upside is strong brand visibility and trust. A 2025 influencer marketing study found that 38% of affiliate-driven revenue came from influencer channels, even though they represented only 20% of partner count. This suggests higher ROI potential, but budget for upfront content fees is essential.

Coupon and deal sites

Coupon affiliates tend to drive volume but at a lower margin. They often negotiate 1–5% commissions or a flat $1–$3 per sale, because they bring price-sensitive customers. If your focus is on profitability rather than pure volume, rely on coupons selectively or layer in conditions like minimum order values to protect margins.

Content creators and niche bloggers

These affiliates craft long-form content like blog posts or product reviews. They usually work on a straight commission model (8–20%), though some top-tier bloggers charge $500–$1,500 for a sponsored post. What makes them cost-effective is evergreen content that continues to convert over time with minimal management. According to 2025 content marketing stats, evergreen affiliate posts deliver 25% of annual affiliate revenue with just 5% of total partner effort.

Loyalty and cashback apps

Platforms like Rakuten or Honey incorporate affiliate links into their user reward structures. They often demand higher commission, 15–30%, because they split earnings with users or pay for technology integrations. The trade-off: they can drive high volumes, but you’ll need to account for the margin pressure. Some brands negotiate tiered commission models or limited-time promotions to make the cost manageable.

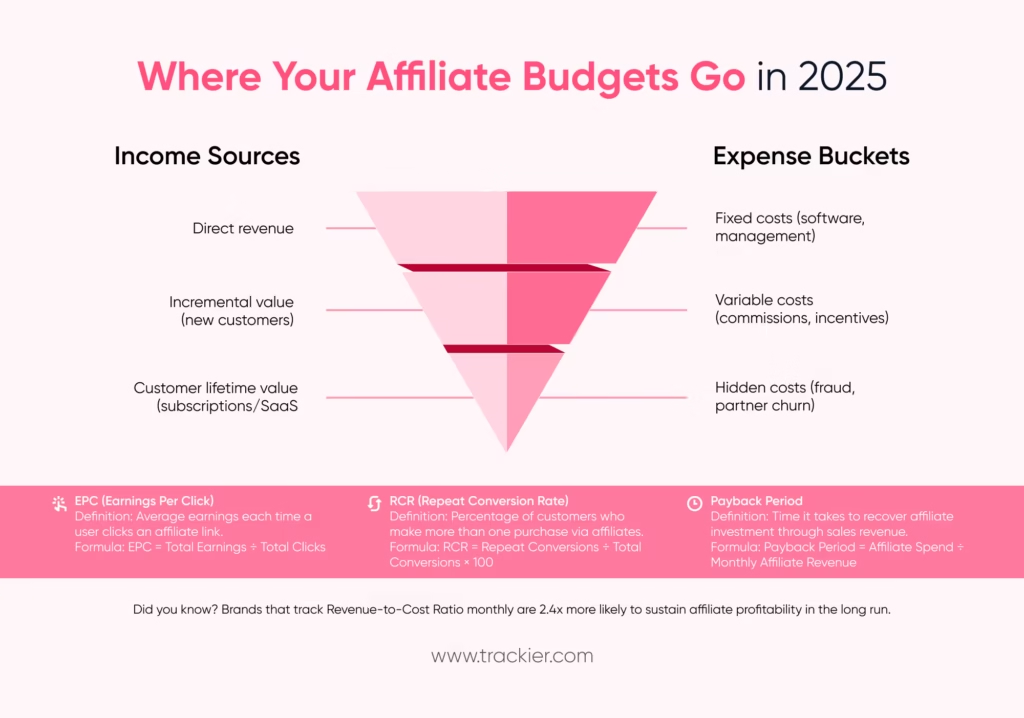

Affiliate marketing income vs expenses

Every affiliate program needs to answer a fundamental question: Does the income justify the expenses? While affiliate marketing is often praised for its cost-effectiveness, the reality in 2025 is more nuanced. Expenses are no longer limited to just payouts, and income depends heavily on program maturity, industry, and the ability to manage partner relationships effectively.

1. Breaking down affiliate marketing income

Affiliate income can be measured in multiple ways depending on a company’s goals:

- Direct revenue: Sales directly attributed to affiliate-driven clicks or leads.

- Incremental value: New customers who wouldn’t have converted without an affiliate touchpoint. According to Impact’s 2025 Partnership Benchmark Report, incremental sales now account for 35% of total affiliate revenue across mature programs.

- Lifetime value (LTV): For SaaS or subscription businesses, income is measured by long-term value of customers acquired through affiliates rather than one-off sales.

A global affiliate study highlighted that 81% of brands reported higher LTV from affiliate-acquired customers compared to other paid channels, proving income streams are not only immediate but compounding.

2. Mapping the expenses side

Expenses in affiliate marketing programs fall under three categories:

- Fixed costs: Tools, software subscriptions, tracking platforms, compliance audits, and management salaries.

- Variable costs: Commissions, bonuses, and performance incentives which scale with sales volume.

- Hidden costs: Fraudulent clicks, partner churn, and opportunity costs when creative assets or landing pages underperform.

A 2025 report shows that fraudulent affiliate activity eats up nearly 9% of total affiliate spend on average. Companies without strong fraud detection systems often miscalculate profitability.

3. Income vs expense ratios to track

To evaluate success, companies should track these ratios:

- Earnings per click (EPC): Shows income earned relative to clicks generated by affiliates.

- Revenue-to-cost ratio (RCR): If revenue is at least 4–5x program costs, the program is typically considered healthy.

- Payback period: Especially for SaaS or subscriptions, how long it takes for affiliate-acquired customers to cover acquisition costs.

For instance, a SaaS company might invest $100 in affiliate commissions for one new customer, but if that customer stays for 18 months paying $40 per month, the LTV of $720 far outweighs the upfront expense.

4. The 2025 profitability trend

Unlike paid ads where costs rise with competition, affiliate marketing offers more stable cost scaling. The reason is simple: commissions are tied to actual results. This makes income-vs-expense dynamics more predictable compared to channels like search or display.

However, program complexity in 2025, like multi-touch attribution, influencer commissions, and tiered partner payouts, means businesses need more refined expense tracking to avoid overspending in the name of growth.

How do affiliate marketing payouts work?

Affiliate marketing payouts are one of the biggest factors influencing profitability for both businesses and marketers. Understanding how affiliate marketing payouts work in 2025 helps brands set clear expectations and gives affiliates insight into how much they can realistically earn.

The common payout models

Most affiliate programs use one (or a mix) of the following models:

- Cost Per Sale (CPS): Affiliates earn a percentage commission for every sale made through their referral link. This is the most common payout model in industries like e-commerce and SaaS. Commissions usually range between 5%–30%, though some programs (like digital products) can go as high as 50%.

- Cost Per Action (CPA): Affiliates earn when users complete a predefined action such as signing up for a trial, downloading an app, or filling out a form. This model is popular in finance, education, and subscription-based niches.

- Cost Per Click (CPC): Less common today, affiliates earn based on the number of valid clicks driven to the advertiser’s site.

- Recurring Commissions: Especially common in SaaS and subscription businesses, affiliates continue earning as long as the customer stays subscribed. For example, platforms like ClickFunnels offer 40% recurring commissions for affiliates.

How payouts are structured

- Flat Rate vs. Percentage-Based: Some businesses prefer a flat payout per lead or sale (e.g., $50 per sign-up), while others provide a revenue-share model (e.g., 20% of every sale).

- Payment Thresholds: Affiliates usually must meet a minimum payout threshold before receiving commissions. For example, Amazon Associates sets a minimum of $10 for payouts.

- Frequency of Payment: Standard payment cycles include monthly, bi-weekly, or net-30 (payment after 30 days). High-performing affiliates may negotiate faster payouts.

Affiliate network influence

When affiliates use networks like CJ Affiliate or ShareASale, payouts are often standardized and backed by platform policies. Direct brand-to-affiliate partnerships, however, sometimes allow more flexible or customized payout structures.

The rise of hybrid payout models

In 2025, hybrid models are gaining traction, brands combine CPS + CPA to reward both immediate conversions and micro-actions. For instance, an affiliate might earn $10 for a sign-up plus 15% commission on the first purchase. This balance encourages affiliates to focus on both lead quality and sales.

Why payout transparency matters

Clear payout policies not only attract high-quality affiliates but also prevent churn. Affiliates want to know exactly how they’ll be compensated and how tracking ensures their work is properly credited. A transparent payout system builds trust and strengthens long-term partnerships.

How can businesses manage affiliate marketing cost more efficiently?

One of the biggest challenges for businesses running affiliate programs in 2025 is not just setting the right budget, but tracking how that money is being spent and ensuring payouts align with actual performance. Many brands still struggle with attribution issues, fraud detection, and inefficient partner management, all of which inflate costs.

This is where affiliate marketing platforms come in. Instead of manually juggling spreadsheets or relying on inconsistent data, businesses can use tools that provide:

- Real-time performance tracking so every click, lead, and sale is visible.

- Automated payout management that reduces the risk of overpaying or missing affiliate commissions.

- Fraud prevention systems to catch suspicious clicks or fake leads before they drain the budget.

- Cross-channel attribution that shows whether a conversion came from an affiliate, influencer, or paid ad.

Platforms like Trackier are designed specifically for this kind of optimization. For example, a brand can use Trackier’s partner marketing platform to identify which affiliates consistently drive high-value customers versus those with high churn. That allows marketing teams to reallocate budgets to the right partners, keeping overall costs predictable while boosting ROI.

By integrating these insights into budgeting decisions, companies can strike a balance between controlling expenses and rewarding affiliates fairly, making the entire ecosystem healthier and more profitable.

What is the best strategy to balance affiliate marketing cost and ROI in 2025?

By now it’s clear that affiliate marketing in 2025 is no longer about “how little can I spend” but rather “how smartly can I invest.” The businesses seeing the best results are the ones who view affiliate programs as profit centers instead of cost centers.

A winning strategy often includes:

Clear budget allocations: separating fixed costs (like tech platforms) from variable payouts tied directly to performance.

Data-led partner management: focusing spend on affiliates who bring loyal, repeat customers rather than one-time signups.

Regular cost audits: checking for hidden inefficiencies like delayed payouts, fraudulent activity, or underperforming affiliates.

Technology adoption: using affiliate management platforms to streamline payouts, attribution, and fraud detection.

When these strategies are consistently applied, the “cost” of affiliate marketing becomes more predictable, and businesses can scale with confidence.

The smarter way to think about affiliate marketing cost

Affiliate marketing is one of the most budget-flexible channels in digital marketing, but flexibility without planning can quickly turn into overspending. In 2025, the brands winning at affiliate marketing are those who track income vs expenses in real time, budget for growth rather than just survival, and use technology to keep their programs efficient.

Whether you’re a startup with a small affiliate budget or an enterprise running hundreds of partnerships, the key is to treat costs as investments in performance. Done right, every dollar spent on affiliates can return multiples in revenue, brand awareness, and long-term customer value.

If you’re mapping out your next steps, ask yourself:

- Do I know exactly where my affiliate budget is going?

- Am I rewarding the right affiliates for sustainable growth?

- Is my program scalable without my costs spiraling out of control?

If the answer isn’t a confident yes, it might be time to review your affiliate budget strategy and invest in tools that give you transparency and control.

Affiliate marketing will always carry costs, but in 2025, the businesses that manage those costs with clarity, data, and the right tech will be the ones seeing the highest ROI.

Hungry For More?

Sign up for our weekly newsletter to get tips like these delivered, straight to your feed.

FAQs

1. How much does affiliate marketing cost?

Affiliate marketing costs vary depending on commission models, partner types, and technology stack. In 2025, most brands allocate 10–30% of their digital marketing budget to affiliate programs.

Costs include:

– Affiliate commissions (typically 5–30% of each sale, depending on industry and partner type).

– Platform fees for tracking and automation software.

– Network fees if using an affiliate network (often 20–30% override on publisher payouts).

– Operational overhead like creative production and fraud prevention.

Unlike paid ads where you spend upfront, affiliate marketing is performance-based, you pay only when results come in. This makes it easier to scale while keeping acquisition costs predictable.

2. What is the 80/20 rule in affiliate marketing?

The 80/20 rule, or Pareto principle, means that 80% of affiliate revenue usually comes from 20% of affiliates.

– These top partners (like established content publishers or loyalty apps) are often the primary revenue drivers.

– The other 80% of affiliates still matter, but they typically generate smaller contributions or act as brand amplifiers.

For program managers, this rule is a reminder to:

– Nurture high-performing affiliates with better incentives and exclusive campaigns.

– Diversify the base so dependence on a handful of affiliates doesn’t create risk.

3. Is affiliate marketing cost cheap?

Affiliate marketing is not “cheap” in the sense of low-quality or low-effort, but it is cost-efficient compared to traditional channels.

– Since payments are tied to performance, the risk of wasted spend is lower.

– However, costs can add up when working with premium affiliates like influencers or cashback apps, where commission rates and bonuses are higher.

– The “hidden cost” is management effort, recruiting, vetting, and nurturing affiliates to keep the program profitable.

So while it’s not free or effortless, affiliate marketing remains one of the most budget-flexible and ROI-friendly strategies available in 2025.