Understanding the cost of getting a customer is necessary for any company making investments in digital growth. Cost per acquisition is an essential metric for long-term growth since it provides you with information about the cost of turning a lead into a paying customer.

You can evaluate the financial efforts of your marketing campaigns by using the cost per acquisition (CPA) metric. With CPA, you can compare marketing results to the amount of money spent, whether you’re growing through affiliates or running ad campaigns. A lot of teams use performance marketing software to monitor, optimize, and reduce acquisition costs while increasing ROI.

What is Cost Per Acquisition?

The total cost a company spends to acquire a single paying client or complete a desired action, like making a purchase, signing up, or downloading an app, is the cost per acquisition. It’s an important digital marketing metric that links your advertising investment to measurable results.

CPA gives an accurate picture of marketing impact because it focuses on actual conversions rather than just tracking clicks or impressions. It’s frequently used together with related terms like cost per user acquisition and cost per customer acquisition, which highlight the amount of money you’re spending to draw in and turn a particular person into a devoted user or buyer.

Why is CPA Important?

When evaluating the success of your marketing and sales efforts, cost per acquisition comes in handy. It helps to figure out whether you’re overspending on customer acquisition or whether your campaigns bring in good results.

While a high CPA could indicate poor targeting, wasted ad spend, or conversion funnel struggle, a low CPA typically indicates that your marketing strategy is working. Tracking CPA is a must for companies with limited resources or trying to grow profitably.

It also helps with cross-channel evaluations, whether through email campaigns, search ads, or influencer collaborations. Businesses can check CPA in real time and make decisions based on data to improve customer acquisition methods.

How to Calculate Cost Per Acquisition

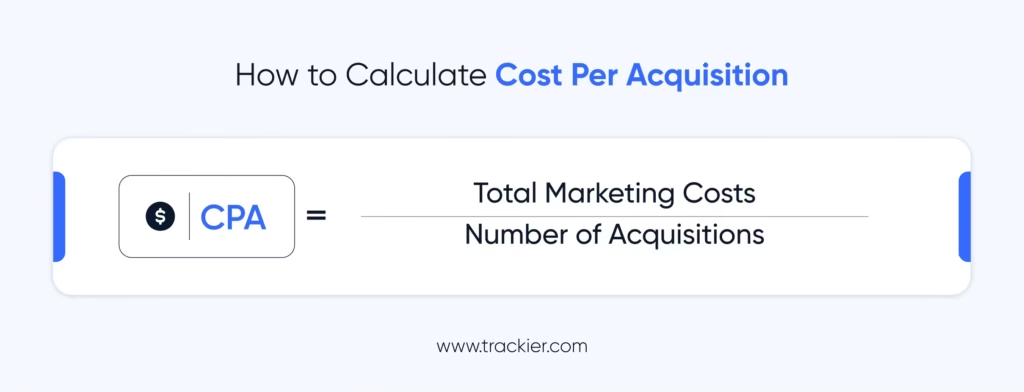

Cost per acquisition is easy to calculate, but using correct data is essential. The basic formula is:

Depending on your business objectives, you can apply this formula to a variety of acquisitions, including sign-ups, purchases, and app installs. Just make sure you’re only including expenses like ad spend, software fees, creative production, or affiliate commissions that are directly related to the particular campaign or acquisition goal.

You can check the success of multiple campaigns or channels and measure profits at a fine level by knowing how to calculate the cost per acquisition.

Example of Cost Per Acquisition

Suppose that a business uses a month-long paid advertising campaign to increase sales of its products. The campaign’s overall budget, including agency fees, content production, and ad placements, comes to $5,000. The business acquired 150 new clients by the end of the campaign.

The CPA formula is as follows: CPA = $5,000 ÷ 150 = $33

This indicates that the business spent $33 on each new client. This CPA can be regarded as either efficient or excessively high, depending on the product’s selling price and profit margin. For instance, a $33 CPA might be viable if each client brings in $120. However, this expense would drastically lower profits if the customer lifetime value is only $45.

What’s a Good CPA?

Since it varies heavily across industries, business models, and customer lifetime value, there is no generic answer to what is a “good” cost per acquisition. For example, an e-commerce company selling $30 products would require a much lower CPA to stay profitable, while a SaaS company might be comfortable with a CPA of $200 if each customer generates $1,000 over time.

A good CPA helps your company attract clients at a lower cost than their expected earnings. To make sure they’re not overspending on expansion, many businesses evaluate this using the cost per customer acquisition formula along with CLV.

Factors That Influence Your CPA

Your cost per acquisition can be influenced by a number of factors, which frequently differ depending on the campaign, platform, or target audience. You can determine where your acquisition strategy needs to be adjusted by understanding these factors.

1. Marketing Channel

CPA typically changes depending on the channel, such as affiliate programs, social media, email marketing, or paid search. Certain platforms might increase your total cost per acquisition by generating lower conversion rates but cheaper clicks.

2. Targeting Audiences

Your chances of reaching high-intent users increase with accurate targeting, which will improve conversion rates and lower your cost per user acquisition.

3. Ad Quality and Creative

Higher engagement and more effective conversions are the results of attractive messaging, images, and CTAs.

4. Conversion Funnel

Acquisition costs may rise as a result of drop-offs caused by a complex or lengthy funnel. Lower CPAs are frequently the result of simplified landing pages and quicker checkouts.

5. Competition and Bidding Strategy

Aggressive bidding or increased competition for ad space can increase your marketing expenses without guaranteeing a rise in conversions.

How to Reduce Your Cost Per Acquisition

You can reduce your cost per acquisition by increasing performance, which means spending less money while gaining more clients. Here are some proven ways:

- Optimize channels that perform well – Increase your efforts in marketing channels that have a record of low CPAs. For eg, you can increase your budget for affiliates or email campaigns if they perform better than paid advertisements.

- Improve segmentation and targeting – Use data to accurately target users who are interested in your product or service. Over time, improved targeting lowers wasteful spending and raises your cost per customer acquisition.

- Make your conversion funnel better – Every stage, from clicking on an advertisement to checking out, should be easy. To reduce friction and increase conversions, A/B test landing pages, CTAs, and page speed.

- Retarget users that show interest – At much less expense than acquiring new users from scratch, retargeting campaigns frequently bring back users who did not convert the first time.

- Use automation resources – Reduce manual errors and increase cost efficiency by automating budget allocation, audience optimization, and bidding strategies.

Limitations of CPA

Even though cost per acquisition is a useful metric, depending solely on it can often result in a wrong performance evaluation. Here are some limitations to be aware of:

Customer Lifetime Value is Not Reflected

CPA doesn’t show how much money the business will make over time. It just shows the cost of gaining a customer. If your customers have a high CLV, you might still be able to get away with a higher CPA.

Ignores Brand Impact and Engagement

Even though they might not result in conversions right away, some marketing initiatives, such as top-of-funnel campaigns or brand awareness, can still be beneficial in the long run. This detail is not captured by the CPA.

Can Be Misleading Across Channels

It can be risky to compare CPA across channels without context. Higher retention or higher-quality leads are not always associated with lower CPAs.

Only Focuses on Acquisition

CPA does not account for customer satisfaction, upselling, and retention. If the churn rate is high, a low cost per customer acquisition won’t make much difference.

CPA should be considered alongside metrics such as CLV, ROI, and retention rate to make conscious marketing decisions.

Final Thoughts

Understanding your cost per acquisition can help you grow more quickly, budget wisely, and build better client relationships. CPA helps in calculating the actual cost of growth, whether you’re checking the cost per customer acquisition across channels or optimizing a campaign.

CPA works best when combined with metrics like ROI, retention, and customer lifetime value. Understanding how to calculate cost per acquisition and how to optimize it is where the real benefit comes from.

By keeping CPA in check and making decisions based on the data, businesses can improve performance, reduce ad spend, and improve their strategies.

FAQs

What does cost per acquisition mean?

A marketing metric called cost per acquisition (CPA) calculates how much a business must spend to acquire a single client or accomplish a particular conversion, such as a purchase or signup. It helps marketers evaluate the impact of their campaigns by directly connecting ad expenditure to outcomes.

What’s the difference between CAC and CPA?

The entire cost to acquire a paying customer, including marketing, sales, and overhead, is measured by the Customer Acquisition Cost (CAC). Cost per Acquisition (CPA) is more specific, focusing only on advertising costs for a single conversion. To put it briefly, CPA is more strategic and campaign-specific, whereas CAC is business-wide.

What is an example of an acquisition cost?

If a business spends $2,000 on a Facebook ad campaign and gains 100 new customers from it, the cost per acquisition is $20. CPA is a straightforward, measurable efficiency metric because it indicates that the business invested $20 in marketing for every new customer.