Affiliate marketing has grown rapidly into a $17.6 billion industry that’s growing about 9% each year. Experts think it’ll hit $28 billion by 2027.

Here’s what’s crazy: 82% of brands are now doing affiliate programs. That means when you buy stuff online, there’s probably someone getting paid a commission. These programs actually drive around 16% of all online sales worldwide.

But managing all this, like affiliate payments, fraud detection, multi-region payouts, and handling affiliate marketing payment methods, gets challenging as your affiliate program scales.

That’s where performance marketing software offers tracking, handling payments in different currencies, catching fraud, and providing dashboards that actually make sense. When there’s this much money floating around, you need systems that work so your affiliates stick around.

What Are Affiliate Payments?

Affiliate payments are the commission or earnings that are paid to the affiliate for their marketing efforts to get desired action, like generating a sale, or lead, or getting app installs. A brand collaborates with affiliates to promote its products or services via unique tracking links.

Affiliates earn a commission when a user completes a desired action. But how do affiliate marketers get paid, and what models are used to reward them? Let’s break it down.

For example, if an affiliate promotes your e-commerce products like hair shampoo or toner and drives a customer to make a purchase, they will get a percentage of that sale, and the payout will be called an affiliate payment.

But what do the affiliate payments include?

- Commissions – A flat fee or percentage

- Bonuses – For completing a performance milestone

- Tiered payouts – Based on traffic or conversion volume

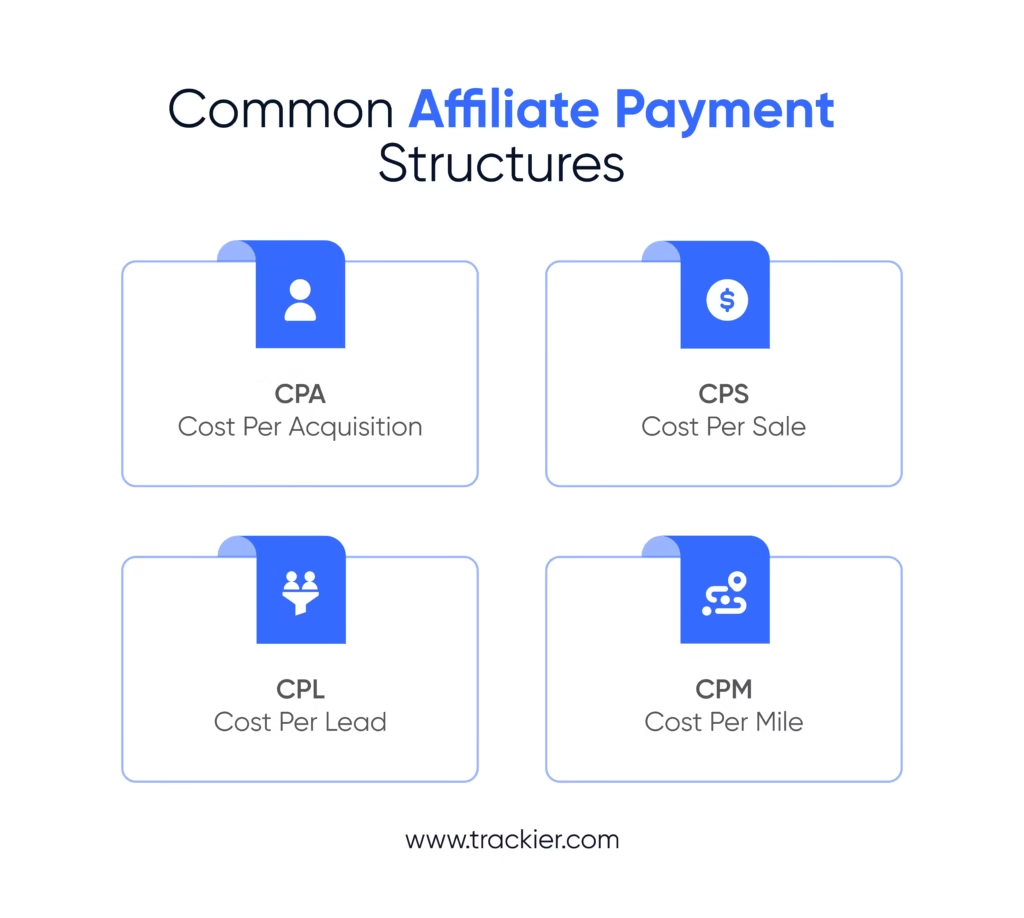

Common Affiliate Payment Structures

Affiliate programs use various payout types to reward their partners based on the value they deliver. However, the right affiliate payment model not only drives results but also attracts quality affiliates and aligns the incentive towards marketing goals.

Here is a breakdown of the most used affiliate payment structure, along with its pros, cons, and ideal scenarios for implementing:

1. CPA – Cost Per Acquisition

In the CPA model, affiliates earn a commission when a user completes a specific action, like a sale, sign-up, or app install. This model is the most common and performance-driven.

Pros:

- You only have to pay when the action is completed

- Measurable and ROI driven

- Easy to scale with automation and proper tracking

Cons:

- Affiliate may be avoided if the acquisition requires multiple steps

- Need accurate attribution to ensure fair payouts

Ideal for:

- E-commerce, SaaS, fintech, and mobile apps

- Performance marketers who are focused on actual results

2. CPS – Cost Per Sale (Revenue Share)

Affiliates get a percentage of each successful sale they have generated. This model incentivizes the partner with commission tiers, for example, 10% for $500+ sales/month. Also, more than 80% of affiliate programs use CPS models.

Pros:

- Risk-free for advertisers

- Encourage affiliates to target high-intent audiences

- Strong alignment with the business value proposition

Cons:

- A longer period of time for conversion may demotivate affiliates

- Need transparent reporting to track the actual sales source

Ideal for:

- E-commerce brands, subscription services, and marketplaces

Trackier helps you to set up revenue sharing models and create flexible playout rules based on the cart value, region, or even affiliate tier.

3. CPL – Cost Per Lead

Affiliates or partners get paid for generating leads in many ways, like contact forms, webinar sign-ups, or registration for the free trial period.

Pros:

- It helps to build a sales funnel and collect the necessary data points

- Affiliates get paid very fast

- This model works very well for high LTV (lifetime value) products

Cons:

- The issue can be the lead quality

- Before making the payouts to the affiliate, it needs to be evaluated

Ideal for:

- B2B software, finance, healthcare, insurance, EdTech companies

Pro tip: To increase the quality of leads, many brands are using Trackier to set a conversion hold period to ensure leads are verified before making the payments.

4. CPM – Cost Per Mile

Affiliates/publishers are paid based on the number of ad views rather than clicks or any actions.

Pro:

- Easy to implement

- Best for brand building or campaign awareness

- Ideal for big content sites

Cons:

- There is no direct link for the conversion or ROI

- There is a very high risk of getting bot traffic if not monitored properly

Ideal for:

- Top of the funnel campaigns

- PR campaigns

- Big content sites

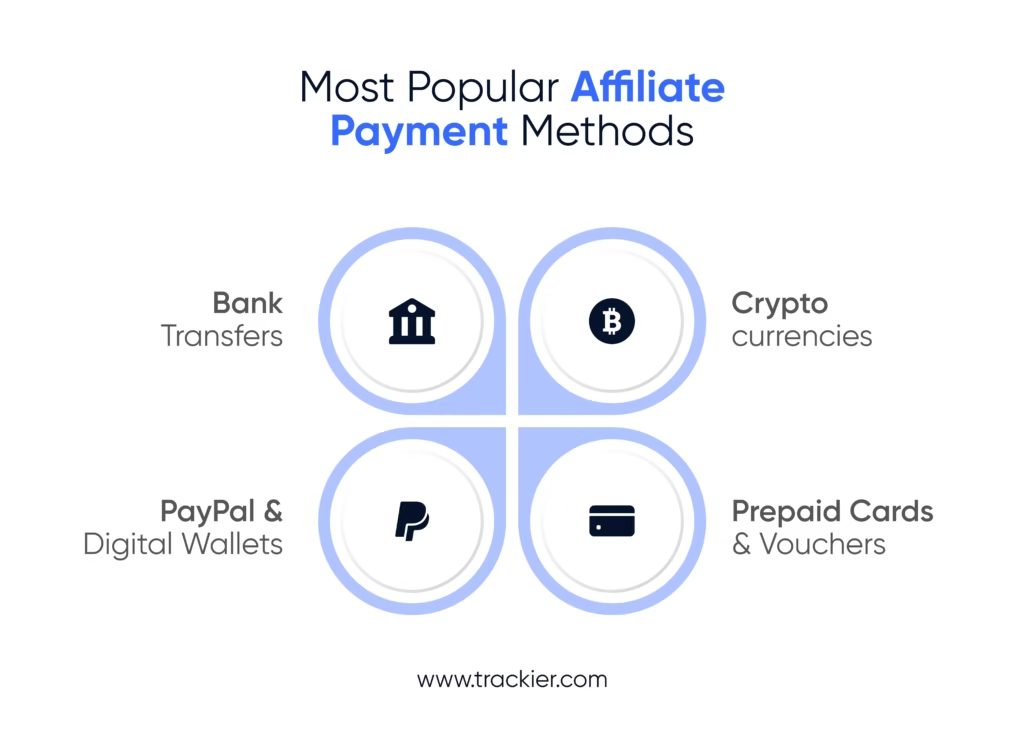

Most Popular Affiliate Payment Methods

Selecting the right affiliate payment methods is a necessary part of running a successful affiliate program. And the reason is that affiliates come from various countries, use many financial tools, and want fast, secure, and low-fee transactions.

To keep your partners happy and scale your program, you have to offer reliable payout solutions that suit their preferences. Here are the most used affiliate payment methods:

1. Bank Transfers

Bank transfer is one of the most old and secure ways for affiliate payment methods, especially for higher payouts. Funds are transferred directly to the affiliate’s account, ensuring it’s trackable and complies with the financial regulations.

Pros:

- Secure and traceable

- Best for high-ticket affiliates

- Works globally via SWIFT or IBAN

Cons:

- Higher transfer fees

- Slower processing time (2-7 business days)

- Need exact banking details

2. PayPal and Digital Wallets

PayPal, Skrill, Payoneer, and similar platforms are most popular amongst affiliate marketers (especially freelancers). These wallets offer fast, global transactions and easy integration with affiliate platforms.

Pros:

- Fast and simple to set up

- Lower fees

- Globally accepted

Cons:

- Limited support

- Disputes and account freezes can happen

- Fees for currency conversion

3. Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum have been rising in recent years, and that is why cryptocurrency payments are getting so popular. Affiliates can be paid in Bitcoin, Ethereum, or stablecoins like USDT, which eliminates the banking restrictions and currency conversion issues.

Pros:

- Fast transaction globally

- Bank accounts are not required

Cons:

- Highly volatile

- Regulatory uncertainty

- Managing crypto wallets

4. Prepaid Cards and Vouchers

Not many, but some affiliate programs offer prepaid debit cards or gift vouchers as a payout option. These payment methods are used in loyalty or cashback programs.

Pros:

- Easy to issue

- Best for small incentives and contests

- Great for niche use

Cons:

- Limited use, as we can not spend it anywhere like a fund

- Less attractive to big affiliates

Instant vs Monthly Payouts: Clear Cycle, Happy Affiliates

Now that you have seen how affiliates are paid (bank transfers, PayPal, crypto), the next critical question is when they get paid. That leads us into payout cycles, which include instant, daily, or monthly. Also, how payout timings impact trust, cost, and operational efficiency.

| Payout Type | Frequency and Timing | Pros | Cons |

| Instant Payouts | Paid immediately after completing a threshold (e.g. $30–$100) | – Instant earnings for affiliates – Attract new affiliates – Build trust | – Higher transaction cost – Fraud risk if conversion is not completed – Not sustainable |

| Daily/Weekly | Frequent scheduled payouts (e.g., daily, or any one day in a week) | – Keep affiliates motivated – Predictable cash flow – Balanced between fraud risks and rewards | – Still requires high operational overhead – Lower perceived value |

| Monthly Payouts | Consolidated payment | – Cost-efficient – Easy reconciliation and auditing | – Affiliates may be frustrated because of slower payouts – Risk of poor retention |

| Hybrid (Instant + Monthly) | Allow instant withdrawals after threshold + default to monthly for smaller balances, or hold period earnings | – Offer flexibility – Lower the overall processing costs – Enable fraud hold on the monthly portion | – Need smart rules and a threshold – Communication risk – Require a comprehensive platform |

Top Challenges in Affiliate Payments

Running an affiliate program is just one thing. But, paying your affiliates efficiently, accurately, and globally is where most of the brands and affiliate managers face major challenges.

Also, affiliate payments are more than just making payouts; it is about building trust, maintaining partner satisfaction, and ensuring long-term scalability of your program. Let’s break down the affiliate payment issues brands and affiliate managers face and how you can solve them.

1. Delayed Payouts Hurt Trust

Your super affiliates are your growth partners. But when their payments are getting late (even by a day), it will affect your brand negatively. Most of the delay happens because of:

- Manually validating the conversion

- Complicated workflows for approval

- Inconsistent payout timelines

Solution: You can automate your payment cycle with an affiliate tracking software that will validate conversions, set a hold period, and make scheduled payments.

2. Fraudulent Traffic and Disputed Conversions

One of the major challenges in affiliate marketing is fraud, and it is estimated to cost the advertiser more than $1.5B/year, while ~30% of programs are impacted by cookie-stuffing. It can be bot traffic, cookie stuffing to PPC brand bidding, and fake leads.

And the major concern is this: if you deny their payments, they will often dispute it. This drains your time so much and weakens your partner relationships.

Solution: Use a fraud prevention software to add rule-based fraud filters, capping on clicks, and setting a hold period for the conversion.

3. Tax and Compliance

As you onboard many affiliates with different regions, you manage KYC, GST, W-8BEN/W-9 forms, and local tax laws based on each country’s specific rules.

Also, for the finance team, manually collecting the documents and the tax filing process takes so much time and resources.

Solution: Use a performance marketing software like Trackier to automate your invoice generation, multi-currency processing, fraud detection, and so many other features.

4. Cross-Border Payments and Currency Complications

When you have to pay your affiliates who operate from different regions, you have to deal with exchange rates, restrictions of payment gateways, and payment options may be different, like some may want the payout through PayPal, and some may demand bank transfers.

Solution: Choose a payout system that offers multi-currency payments and multiple payout methods that help you to maintain affiliate satisfaction and build good relationships across regions.

5. Confusion Around Hold Period and Thresholds

Your affiliates may leave your affiliate program if they don’t know why their payouts are delayed. They have confusion around payout thresholds, validation timelines, and return windows that may lead to mistrust.

Solution: Communicate with your affiliates and guide them about the payment logic clearly. Trackier’s comprehensive dashboard shows pending vs approved commissions, payout thresholds, and estimated payout dates that help reduce the queries of your affiliates.

6. Broken Payment Systems and Technical Failures

Spreadsheets crash, APIs do not work properly, and manual records can go missing. Also, if your payout system is not reliable, there is a risk of duplicate payments, missed commissions, or data loss.

Solution: Choose a platform that is designed for affiliate operations and offers centralized tracking, validation, and payouts.

7. Invoicing Structure: Slow Down the Payment Cycle

Not every affiliate is are blogger or influencer. Many of them could be agencies, media buyers, and B2B partners who require formal invoices for each payment cycle.

If you are manually collecting invoices, matching them with the performance report, and connecting with the finance team to make the payouts will slow down the process.

This process becomes more complex when:

- GST or VAT needs to be applied

- Invoice formats vary by country

Solution: Use affiliate software that generates invoices automatically for each payout cycle with affiliate details.

8. High-Risk Industry Discrimination

If your brand operates in a high-risk domain like crypto, gambling, gaming, forex, or adult content, there are higher chances that many payment providers may deny payouts to the affiliates, freeze funds without any prior notice, or require heavy documentation and long approval cycles.

Solution: Choose a payout software that is compatible with high-risk industry domains and offers integration with other gateways.

9. PPC Fraud and Link Theft

Many fraudulent affiliates drain your commissions. This often happens through:

- PPC brand bidding – Affiliates compete against your brand on search engines and drive up your CPC.

- Link hijacking or cookie stuffing – A bad affiliate overwrites another partner’s cookie to take the credit for a conversion.

Solution: Implement brand bidding protection, smartlink targeting, redirection rules, and conversion validation filters.

10. Affiliate Programs Offline Issues

Your affiliate program runs 24/7. But what if your tracking system goes offline, links break, or a server issue causes the loss of conversions? Your affiliates will lose trust, challenge the missed commissions, and maybe leave your affiliate program.

Solution: Use Trackier, which offers 99.9% uptime, automatically backs up the tracking URLs, and provides real-time monitoring.

Tax Compliance: Region-Specific Examples for Affiliate Payments

Dealing with affiliate payments across regions? Every country has different rules, different paperwork, and different thresholds that trigger tax requirements. Your affiliates and finance teams are probably confused.

Here is what you need to know about handling affiliate payments in the biggest markets like India, the USA, Canada, the UK, Australia, and the EU.

1. United States — W‑9, 1099‑NEC & 1099‑K

So, you are paying affiliates in the US? If they are not a corporation, and you are paying them more than $600 a year via bank transfers, ACH, or checks, you need their W-9 form right when they sign up. Do not wait until tax season; get it upfront.

Then comes January 31st (mark your calendar), when you have to send Form 1099-NEC to both the affiliate and the IRS. But here is a trick that saves so much time; if you are paying through PayPal or credit card processors, they handle the 1099-K forms when thresholds are hit. That means you are off the hook for filing the NEC yourself.

2. India – GST, and Export of Services (OIDAR)

Indian affiliate earnings fall under OIDAR services (Online Information and Database Access or Retrieval). Usually, this means 18% GST applies.

But if you are getting paid by foreign companies, there is a workaround. You can structure payments are exports using a Letter of Undertaking and issue zero-rated ISGT invoices.

Once you are earning above ₹20 lakh per year, GST registration becomes mandatory. Then, you will need proper invoices, like SGST/CGST, for domestic clients or IGST under LUT for foreign ones.

3. Canada – GST/HST, and Business Income Reporting

Canadian affiliate income counts as business or self-employment income. Earning over CAD 3,500 yearly? Time to declare it. Hit CAD 30,000, and you will need to register for GST/HST and start collecting it from Canadian clients.

Foreign payments need to be converted to CAD properly declared, and might trigger withholding tax implications. The good news? You might qualify for foreign tax credits to offset some of that burden.

4. United Kingdom — Self‑Assessment, VAT & NICs

UK affiliates making over £1,000 annually must register as self-employed with HMRC and file self-assessment returns. The personal allowance covers up to £12,570 tax-free, but anything above gets taxed at 20-45%.

VAT registration starts at £85,000 annual turnover, though most affiliate income won’t hit that unless you are selling physical products directly. However, the HMRC plans to increase the self-assessment threshold to £3,000 soon.

5. Australia – GST & Income Tax Reporting

Australian affiliate commissions qualify as business income. Cross AUD 75,000 in total turnover, and you will need GST registration along with Business Activity Statements filing. However, if most payments come from overseas sources, different thresholds might apply, and always double-check with the ATO.

6. European Union – VAT, MOSS & OSS Rules

EU affiliate services, especially promotional links, webinars, or software, often trigger VAT obligations. Working across multiple member states? The VAT MOSS scheme (now called OSS) lets you handle unified VAT reporting and payments from one EU country instead of dealing with each nation separately.

The tricky part is figuring out which countries’ rules apply and when thresholds get triggered. Each member state has different requirements, so local advice becomes pretty essential once you are operating across multiple EU markets.

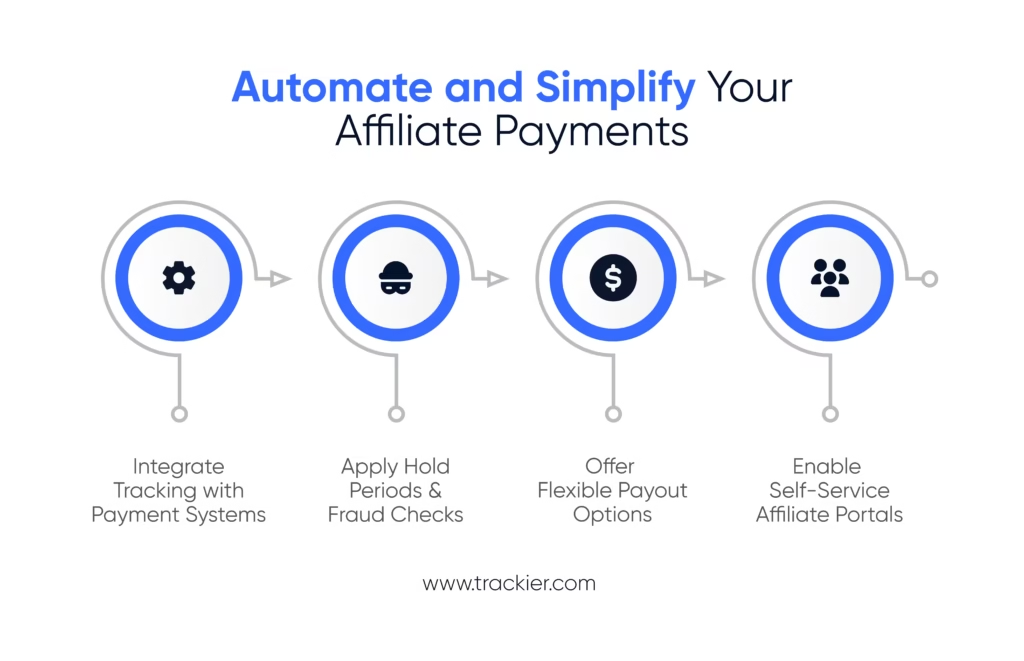

How to Automate and Simplify Affiliate Payments?

Managing thousands of affiliate payments can be challenging, as brands have to manage multiple campaigns, global partners, various commission structures, and payout deadlines.

Relying on spreadsheets can cause late payments, errors, and your affiliates can be frustrated. This is where you should use affiliate payment automation.

By integrating the right payout software, businesses can streamline the entire process. Here are some simple ways to do that:

1. Integrate Tracking with Payment Systems

First, use a centralized platform where conversion tracking and payment data can be connected. When you use Trackier, every affiliate’s actions, like sales or leads, will be automatically logged and validated.

After conversions are qualified, the system will calculate the payable amount based on your payout rules, like:

- CPA

- CPS

- CPL

- Tiered commissions

- Location or device-specific rules

2. Apply Hold Periods and Fraud Checks

Before releasing any payment to affiliates, it is essential to validate whether the transaction is genuine or not. So, add a conversion hold period to get the insights into product returns, subscription cancellations, or fraudulent activities.

With affiliate payment automation, you can:

- Set custom hold duration

- Block fraud activities

- Automatically exclude invalid or refunded transactions

3. Offer Flexible Payout Options

Affiliates want fast and flexible payment options. By using affiliate payout software, you can pay into multiple payment methods, including:

- Bank transfers

- PayPal and digital wallets

- UPI (India)

- Crypto payments (optional)

You can also set minimum payout thresholds, scheduled payment cycles like weekly or monthly, and also allow your affiliates to choose their preferred payment method.

4. Enable Self-Service Affiliate Portals

Do not let your team handle boring or repetitive tasks like telling the affiliates their payment status. With the right performance marketing software, you can give access to your affiliates to:

- Track their earnings in real-time

- View payment history

- Download invoices or statements

- Choose payment preferences

How Trackier Streamlines Affiliate Payouts?

Affiliate managers and brands face multiple challenges, including conversion, attribution, fraud, cross-border payment complexity, inconsistent invoicing, and outdated processes. Trackier is designed to address these issues by offering a unified solution to streamline payouts.

1. Automated Invoicing and Reconciliation

With Trackier’s automated invoicing, you can generate payment invoices based on payout frequency and thresholds. The system matches invoices to actual payments, helping in effortless reconciliation and eliminating manual finance workflows.

2. Customizable and Granular Payout Structures

Trackier offers flexibility:

- Publisher-specific payouts – Assign a custom rate to each affiliate, campaign, geography, or device.

- Tiered payout templates – Reward top affiliates with different payout rates or give them bonuses.

3. Global Payment Flexibility

Trackier supports multi-currency payouts that reduce conversion fees and offer local payment support, which is tailored to affiliate preferences. Whether affiliates demand INR, USD, or any other currencies, payouts are streamlined and transparent.

4. Smart Payouts and Workflow Automation

Set smart payout rules that help you define when and how affiliate payments are triggered. It can be based on performance milestones, specific events, or timing windows.

5. Built-In Fraud Protection

Trackier offers anti-fraud layers like validation for click-level, SmartLink routing, and rule-based filters. This feature ensures you only pay for the verified conversion and reduces the number of disputed payouts.

6. Real-Time Reporting and Dashboard Transparency

We offer real-time reporting and provide full transparency that you can see in your dashboard. Affiliates and managers get clear and real-time insights into pending vs approved commissions, payment status, and invoice history. This transparency reduces the number of queries and builds trust between partners and brands.

Want to see real case studies?

- AdzCircle Media: 28% ROI growth, 35–40% fraud reduction, 20% lower CAC

- iAvatarZ Digital: 3100% profit surge, 27% cut in fraud, 3–5% higher ROAS

- LFG Projects: 80% ROI growth, 100%+ lift in segment traffic

Wrapping Up

Affiliate payments are not just about making payouts. They are what keep your affiliate relationships strong, build real trust, and drive actual growth. Affiliate marketing is booming; we’re talking about a $17 billion industry expected to hit $27.8 billion by 2027. With these numbers, your payment systems had better be solid.

What did we cover? How affiliate payments work–commissions, bonuses, tiered structures. The main payment models are CPA, CPS, CPL, and CPM. The messy stuff, like delayed payments, fraud, and international complications. What affiliates want? They need bank transfers, PayPal, and crypto options.

Here’s the thing: affiliate payment management isn’t a side task. When payment systems break down, everything else falls apart–loyalty, retention, scalability. If you’re running affiliate programs, time for an honest look at your setup:

- Are payments transparent?

- Do systems integrate?

- Can you handle global payouts?

If you’re still using spreadsheets, you’re missing serious budget and growth opportunities. Trackier gets this. We provide centralized tracking, automated payouts, compliance support, and user-friendly dashboards. It’s built to help you scale without any serious challenges.

FAQs

1. How often do affiliates get paid?

It depends on which program you are working with. Most go with monthly payments, either in 30 or 60 days after the month ends. Some of the faster-moving platforms, especially those dealing with leads, might pay weekly or every two weeks. The best programs offer instant payouts once you hit a certain minimum balance. Just make sure to check the terms so you know exactly when to expect your money and if there is any holding period.

2. What are common affiliate payment methods?

You have got many options these days. PayPal is one of the most popular; it is quick and easy, though they do take a small fee. Bank transfers are secure but can take a few days longer. Digital wallets are becoming more common, and yeah, even crypto payments are a thing now. Some networks will send you prepaid cards or pay in your local currency, which is pretty convenient.

3. Why is there a payout threshold or hold period?

This is basically the company protecting itself. The threshold means you need to earn a minimum amount, maybe $50 or $100, before they’ll make you a payout. Makes sense from their end since processing small payments gets expensive. The hold period, usually 30 to 60 days, gives them time to handle returns, chargebacks, or get final approval from advertisers.

4. How does affiliate commission tracking work?

When someone clicks your affiliate link, it drops a little tracking cookie on their browser. If they buy something within the cookie timeframe, usually around 30 days, you get credit for the sale. Different programs have different rules about how long that window stays open and what counts as a qualifying purchase.

5. What to do if affiliate payment is delayed or missing?

Start by double-checking the program’s payment schedule and your dashboard to see what’s showing up. If something looks off, reach out to their support team with your tracking info and transaction details. Most of the time, it’s just a timing thing or a small technical hiccup. If they keep giving you the runaround, you might need to escalate through the affiliate network or get someone else involved.

6. Do affiliate programs require tax or identity information?

Yep, especially the legitimate ones. They’ll want your tax ID, whether that’s your Social Security Number, EIN, PAN, or GST number, depending on where you are. This isn’t them being noisy; they need it for tax reporting and compliance. In the US, they’ll send you a 1099 if you earn more than a certain amount. It’s all about keeping everything above board and legal.

7. How do affiliate marketers get paid?

Affiliate marketers get paid through different payment models like CPA, CPS, or CPL. Once someone takes the desired action through their unique link, they earn a commission. Payments are usually sent via PayPal, bank transfer, or other digital wallets on a set schedule.

8. What is the best way to pay affiliates globally?

The best way is to use a payment platform that supports multiple currencies and payout methods like PayPal, bank transfer, or even crypto. It is all about providing flexibility. Provide your affiliates with the best methods, automated payouts, and make sure fees are low and transfers are fast.